Marketplace Insurance: Find Affordable Health Coverage For Individuals And Families

Marketplace Insurance offers a solution to find affordable health coverage for individuals and families. With the rising cost of healthcare, it's crucial to explore options that provide quality healthcare at accessible prices. Enter Marketplace Insurance, a program designed to assist individuals in securing health insurance plans that meet their specific needs and budgets.

Editor's Note: As of today's date, Marketplace Insurance has released new information that empowers individuals and families to make informed decisions regarding their healthcare coverage. To stay updated and grasp the importance of this topic, continue reading our guide.

To provide comprehensive assistance, we've conducted thorough research and gathered essential information. This guide on Marketplace Insurance: Find Affordable Health Coverage For Individuals And Families aims to equip you with the knowledge necessary to make the right choice when selecting a health insurance plan.

FAQs

This FAQ section provides comprehensive answers to frequently asked questions about Marketplace Insurance, a valuable resource for individuals and families seeking affordable health coverage.

Individual Health Insurance Plans & Quotes California | HFC - Source www.healthforcalifornia.com

Question 1: What is Marketplace Insurance?

Marketplace Insurance is a government-regulated platform that facilitates access to affordable health insurance plans for individuals and families who do not have employer-sponsored coverage or meet specific eligibility criteria.

Question 2: Who is eligible for Marketplace Insurance?

Generally, U.S. citizens or legal residents who are not eligible for Medicaid or Medicare and do not have access to affordable employer-sponsored coverage may qualify for Marketplace Insurance.

Question 3: How can I apply for Marketplace Insurance?

Individuals and families can apply for Marketplace Insurance through HealthCare.gov or through a licensed insurance agent or broker. The application process typically requires information such as income, household size, and health status.

Question 4: What types of plans are available through Marketplace Insurance?

Marketplace Insurance offers a range of plan types, including Bronze, Silver, Gold, and Platinum plans. These plans vary in terms of monthly premiums, deductibles, and out-of-pocket costs, providing options to suit different financial needs.

Question 5: Is Marketplace Insurance affordable?

To make Marketplace Insurance more affordable, premium tax credits and cost-sharing reductions may be available to eligible individuals and families. These subsidies can significantly reduce the monthly cost of coverage.

Question 6: When can I enroll in Marketplace Insurance?

Open enrollment for Marketplace Insurance typically runs from November 1st to January 15th each year. Outside of this period, individuals and families may qualify for special enrollment periods due to certain life events, such as losing job-based coverage.

To learn more about Marketplace Insurance and its benefits, explore HealthCare.gov or consult with a licensed insurance agent or broker.

Transition to next section: Marketplace Insurance provides a comprehensive and accessible solution for individuals and families to obtain affordable health coverage, ensuring access to quality healthcare services.

Tips

Shopping for health insurance is essential, yet it can be daunting. If you are looking for affordable health coverage for individuals and families, the following tips can be of great help. Marketplace Insurance: Find Affordable Health Coverage For Individuals And Families provides a variety of plans to choose from, making it easier to find the right coverage for your needs.

Tip 1: Understand your health insurance needs.

Before you start shopping for health insurance, it’s important to understand your needs. Consider your age, health, and lifestyle. Do you have any pre-existing conditions? Do you take any prescription medications? Once you know your needs, you can start comparing plans that offer the coverage you need.

Tip 2: Shop around and compare plans.

Don’t just buy the first plan you see. Take the time to shop around and compare plans from different insurance companies. Consider the cost of the monthly premium, the deductible, and the co-pays. You should also read the policy carefully to make sure you understand what is covered and what is not.

Tip 3: Take advantage of subsidies.

If you qualify for subsidies, you can lower the cost of your monthly premium. Subsidies are available to individuals and families with incomes below a certain level. To see if you qualify for subsidies, visit Healthcare.gov.

Tip 4: Use a broker.

If you are having trouble finding the right health insurance plan, you can use a broker. Brokers are licensed professionals who can help you compare plans and find the best one for your needs. Brokers typically charge a fee for their services.

Tip 5: Enroll during open enrollment.

Open enrollment for health insurance is typically from November 1st to January 15th. During open enrollment, you can enroll in a new health insurance plan or change your existing plan. If you miss open enrollment, you may have to wait until the next open enrollment period to enroll in a new plan.

Choosing the right health insurance plan can be a daunting task, but it’s important to take the time to find the right plan for your needs. By following these tips, you can find affordable health coverage for yourself and your family.

Marketplace Insurance: Find Affordable Health Coverage For Individuals And Families

Marketplace insurance plans offer a range of options to meet the health coverage needs of individuals and families. Understanding the key aspects of these plans is crucial for making informed healthcare decisions.

- Affordable Coverage: Marketplace plans are designed to provide cost-effective coverage, with subsidies and discounts available for qualifying individuals.

- Choice of Plans: Individuals can choose from a variety of plan types, including HMOs, PPOs, and EPOs, each with varying levels of coverage and costs.

- Flexible Enrollment: Open enrollment periods allow individuals to enroll in coverage annually, while special enrollment periods accommodate life events that may require changes.

- Quality of Care: Marketplace plans meet specific quality standards, ensuring access to comprehensive medical care and essential health benefits.

- Provider Network: Individuals have access to a network of healthcare providers, including primary care physicians, specialists, and hospitals.

- Tax Breaks: Premium tax credits and cost-sharing reductions are available to eligible individuals, further reducing the cost of coverage.

These key aspects provide a comprehensive overview of marketplace insurance, empowering individuals and families to make informed healthcare decisions. By considering these factors, individuals can access affordable coverage tailored to their specific needs and circumstances.

Individuals & Families Overview - Source healthoptions.org

Marketplace Insurance: Find Affordable Health Coverage For Individuals And Families

Marketplace Health Insurance is a critical component of the healthcare system, allowing individuals and families to access comprehensive and affordable health coverage. It plays a significant role in improving the health and well-being of the population by providing access to essential preventive care, chronic disease management, and emergency services.

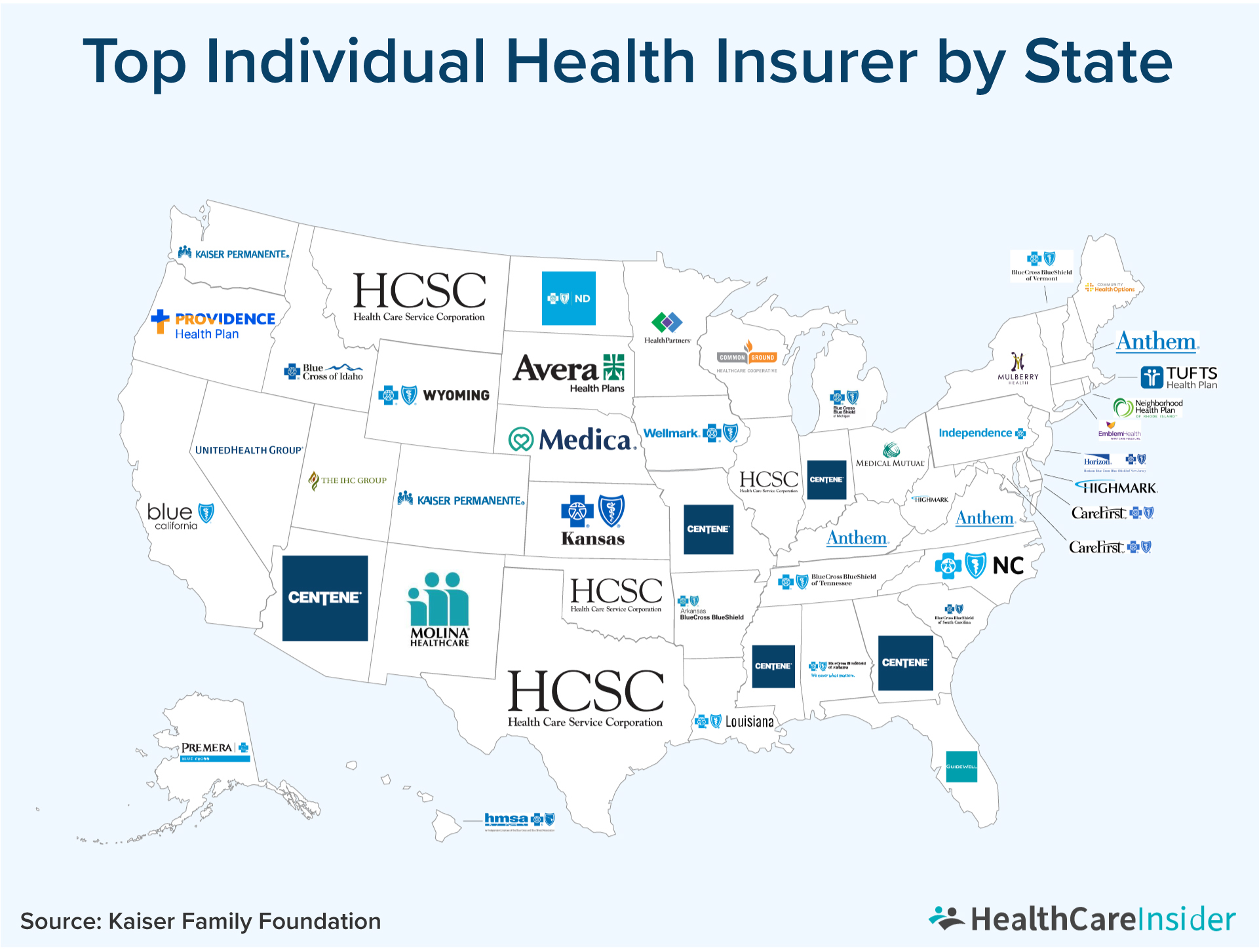

Marketplace Insurance vs. Private Health Insurance Plans - Source healthcareinsider.com

The importance of Marketplace Health Insurance is reflected in its impact on health outcomes. Studies have shown that individuals with health insurance are more likely to receive regular check-ups, screenings, and vaccinations, resulting in early detection and treatment of diseases. Additionally, they have better access to specialist care and prescription drugs, which can improve their overall health and quality of life.

Furthermore, Marketplace Health Insurance provides financial protection against unexpected medical expenses. Without health insurance, individuals and families can face significant financial burdens in the event of an accident or illness. Marketplace Health Insurance helps to buffer these costs and ensures that people can access the care they need without facing financial ruin.

Conclusion

Marketplace Health Insurance is a critical program that plays a vital role in improving the health and well-being of individuals and families. It provides access to affordable health coverage, improves health outcomes, and offers financial protection against unexpected medical expenses. As the healthcare system continues to evolve, Marketplace Health Insurance will remain an essential component, ensuring that all Americans have access to the quality healthcare they deserve.

The ongoing challenges in healthcare, such as rising costs and the need for increased access to care, underscore the importance of Marketplace Health Insurance. It provides a viable solution to these challenges by offering affordable coverage options and expanding access to essential healthcare services.

Discover [Province Name]: A Comprehensive Guide To Its History, Culture, And Destinations, Locust Park Colonie NY: A Haven For Tranquility And Prime Location, Kentucky Derby 2025: The Run For The Roses Returns To Churchill Downs, Mollie Hemingway: Defending Freedom, Exposing Corruption, Travis Kelce Jersey Number: An In-Depth Exploration, Fire Weather Watch: Elevated Fire Danger In [Affected Region], Jack McBrayer: Emmy-Nominated Actor, Comedian, And Voice Artist, FC Barcelona Femení: Reigning Champions Of European Women's Football, Penn State V. Michigan: Rivalry Renewed In Historic Gridiron Clash, Flu A: Early Onset, Severe Symptoms, And Treatment Options,