2025 Spanish Personal Income Tax Thresholds: An Overview Of Changes

Our team has done extensive analysis, digging into the data, and put together this 2025 Spanish Personal Income Tax Thresholds: An Overview Of Changes guide to help the preparation.

FAQ

This article provides a comprehensive overview of the changes to the Spanish Personal Income Tax (PIT) thresholds for 2025. To clarify any further queries, we have compiled a list of frequently asked questions and their respective answers.

Question 1: What are the key changes to the PIT thresholds for 2025?

Answer: The 2025 PIT thresholds have undergone significant adjustments, including an increase in the minimum taxable income, adjustments to the tax brackets, and a reduction in the marginal tax rates.

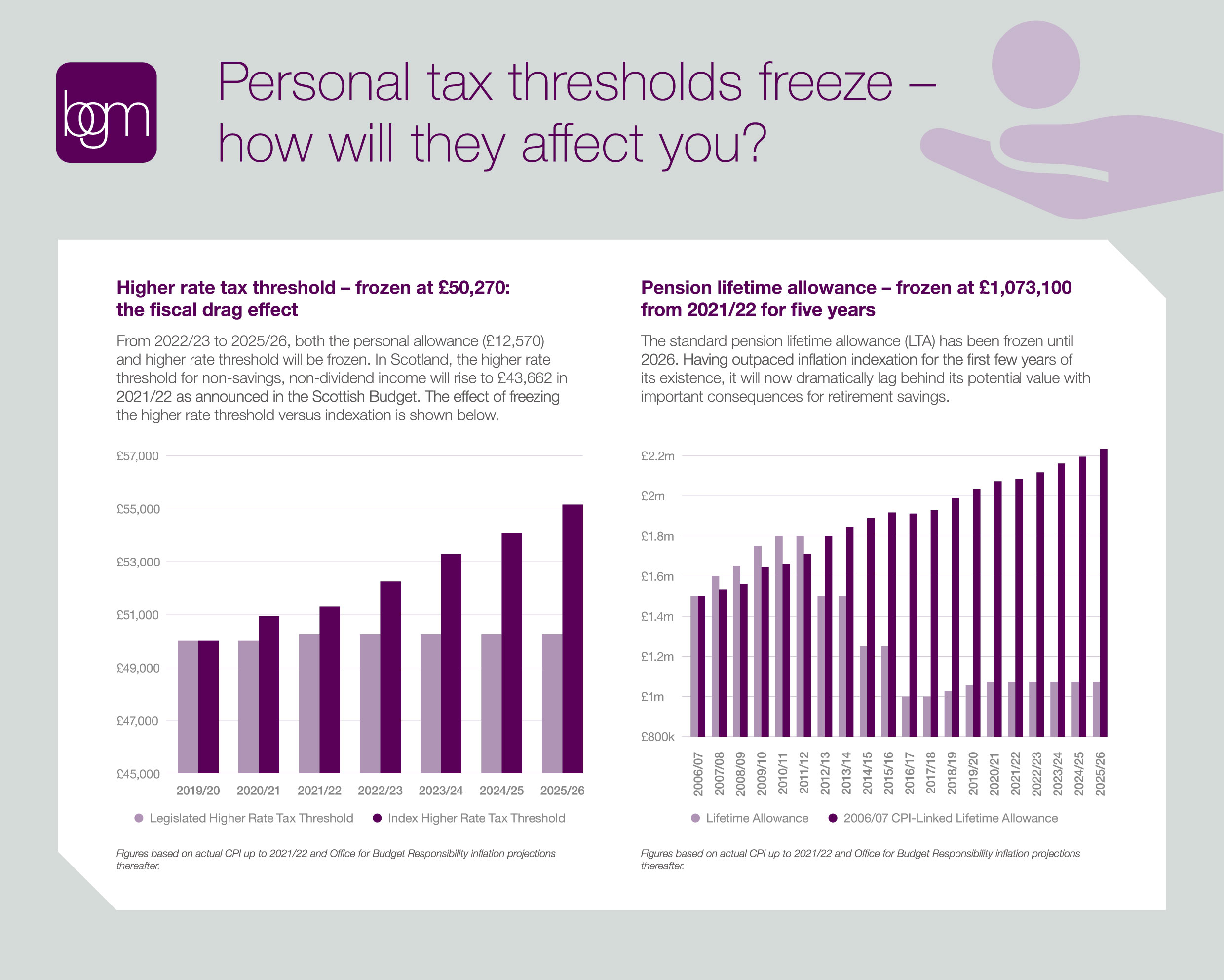

Personal tax thresholds freeze – how will they affect you? | News - Source www.bgm.co.uk

Question 2: How do these changes impact taxpayers?

Answer: The revised thresholds generally result in lower tax burdens for most taxpayers, particularly those with lower incomes. The increased minimum taxable income exempts more individuals from paying PIT, and the reduced marginal tax rates lead to lower tax liabilities.

Question 3: What is the rationale behind these adjustments?

Answer: The Spanish government implemented these changes to align the PIT system with current economic realities, promote economic growth, and alleviate the tax burden on individuals and families.

Question 4: How can I determine my PIT liability under the new thresholds?

Answer: To calculate your PIT liability, you can refer to the official tax tables provided by the Spanish Tax Agency, which incorporate the revised thresholds and tax rates.

Question 5: Are there any additional changes to the PIT system apart from the thresholds?

Answer: Yes, the government has also introduced other modifications, such as adjustments to tax deductions, allowances, and exemptions. It is recommended to consult the official sources for a comprehensive understanding of these changes.

Question 6: Where can I find more information about these PIT threshold changes?

Answer: The Spanish Tax Agency's website provides detailed information on the 2025 PIT thresholds and other relevant updates. You may also seek professional advice from tax experts to ensure accurate interpretation and application of the revised regulations.

Summary: The 2025 Spanish Personal Income Tax threshold adjustments aim to simplify the tax system, reduce the tax burden on individuals, and stimulate economic activity. Taxpayers are advised to carefully review these changes and seek guidance if necessary to accurately determine their tax liabilities and take advantage of the revised provisions.

Transition: For a deeper understanding of the implications of these PIT threshold changes, refer to the comprehensive article on "2025 Spanish Personal Income Tax Thresholds: An Overview Of Changes."

Tips

In 2023, the Spanish government increased the personal income tax thresholds to adjust for inflation, providing relief to taxpayers. Here are some tips to assist understanding these changes:

Tip 1: Understand the new thresholds. The minimum threshold for 2025 has been raised to €15,000, meaning individuals earning less than this amount will be exempt from paying personal income tax. For those earning between €15,000 and €20,000, the tax rate has been reduced from 19% to 17%.

Tip 2: Utilize available tax deductions. Various deductions, such as those for retirement contributions and mortgage interest, can reduce your taxable income. Exploring these deductions can potentially lower your tax liability.

Tip 3: Consider tax-advantaged savings plans. Contributions to certain pension plans and investment accounts may be eligible for tax deductions or exemptions. Utilizing these plans can help reduce your tax burden and secure your financial future.

Tip 4: Seek professional advice. If you have complex financial circumstances or require specific tax guidance, consider consulting a tax advisor. They can provide personalized advice tailored to your situation, helping you optimize your tax strategy.

Tip 5: Stay informed about tax changes. Tax laws and regulations are subject to change periodically. Staying up-to-date on the latest developments can help you plan effectively and avoid unexpected tax liabilities.

By following these tips, you can better navigate the Spanish personal income tax system and potentially reduce your tax burden. For more information, refer to the official 2025 Spanish Personal Income Tax Thresholds: An Overview Of Changes.

2025 Spanish Personal Income Tax Thresholds: An Overview Of Changes

The Spanish government has announced significant changes to the personal income tax thresholds for 2025, impacting taxpayers across the country. Understanding these modifications is crucial for individuals to plan their finances effectively.

- Increased Thresholds: The basic personal income tax allowance will increase, reducing the taxable income for many individuals.

- Progressive Rates: The tax rates will continue to be progressive, with higher earners paying a higher percentage of their income in taxes.

- Deductions and Allowances: The government has introduced new deductions and allowances that can further reduce the tax liability for certain individuals, such as those with children.

- Inflation Adjustments: The thresholds will be adjusted annually for inflation, ensuring that the real value of the tax-free allowance is maintained.

- Regional Variations: Some Spanish regions have their own income tax rates and thresholds, which may differ from the national averages.

- Impact on Paycheck: The changes will impact the net income received by taxpayers, potentially increasing their disposable income and affecting their financial planning.

The implementation of these changes aims to alleviate the tax burden on Spanish citizens, particularly those with lower incomes. By increasing thresholds and introducing additional deductions, the government aims to promote economic growth and improve the overall well-being of taxpayers. It is essential for individuals to consult with tax professionals or use online tax calculators to determine the specific impact these changes will have on their personal tax liability.

New NZ Tax Thresholds | Monteck Carter - Source mc2ca.co.nz

2025 Spanish Personal Income Tax Thresholds: An Overview Of Changes

The Spanish government has announced changes to the personal income tax thresholds for 2025. These changes are designed to reduce the tax burden on low- and middle-income earners. The new thresholds will be as follows:

Tax Act 2025 Software - Sadie Hiba - Source sadiehiba.pages.dev

The new thresholds will mean that a single person earning up to €12,643 will pay no income tax in 2025. This is an increase from the current threshold of €12,450. The threshold for couples will also increase from €19,200 to €19,800.

The changes to the personal income tax thresholds are part of a wider package of measures designed to reduce taxes for low- and middle-income earners. The government has also announced plans to increase the minimum wage and to reduce the social security contributions paid by workers.

The changes to the personal income tax thresholds are expected to benefit around 15 million people. The government estimates that the changes will reduce the tax burden on these people by an average of €200 per year.

The changes to the personal income tax thresholds have been welcomed by trade unions and anti-poverty campaigners. However, some economists have expressed concerns that the changes could lead to a decrease in tax revenue.

| Income Range | Tax Rate |

|---|---|

| €0 - €12,643 | 0% |

| €12,644 - €21,000 | 19% |

| €21,001 - €35,200 | 24% |

| €35,201 - €60,000 | 30% |

| €60,001 - €300,000 | 37% |

| €300,001+ | 45% |

Conclusion

The changes to the Spanish personal income tax thresholds for 2025 are a significant development. They will reduce the tax burden on low- and middle-income earners and are part of a wider package of measures designed to improve the lives of these people.

The changes are expected to have a positive impact on the Spanish economy. They will increase disposable income for low- and middle-income earners, which will boost consumer spending and economic growth.

2023 Gaceta Hípica: Comprehensive Guide To Thoroughbred Racing News And Results, Discover The Enchanting Pinnacle Of The Isle Of Skye: Aj Storr, The Ultimate Guide To The NBA: History, Teams, Players, And More, The Ultimate Guide To Cryptocurrencies: Unraveling The World Of Digital Assets, Inflation Surges: Understanding The Causes And Consequences, León Vs. Guadalajara: A Clash Of Titans In Liga MX, Ogden Fire: Devastating Blaze Destroys Historic Building, Leaving Community In Heartbreak, Joe Keery: From "Stranger Things" Breakout To Multi-faceted Star, Fanduel Outage In New Jersey: Causes And Latest Updates, Lincoln Riley Act: Historic College Sports Legislation Reshaping College Football,