Inflation Surges: Understanding The Causes And Consequences

Editor's Note: "Inflation Surges: Understanding The Causes And Consequences" published today, provides imperative insights into the recent surge in inflation and its far-reaching consequences for both individuals and economies.

Through extensive analysis and research, our team has compiled a comprehensive guide that unravels the complex dynamics of inflation, its root causes, and the potential implications it may bear. This guide aims to empower readers with the knowledge necessary to navigate the challenges and opportunities presented by inflation.

Transition to main article topics: Understanding the Causes of Inflation Surges, Impact of Inflation on Individuals and Economies, Strategies to Mitigate Inflation, and Emerging Trends in Inflation Management.

FAQ

This FAQ section provides comprehensive answers to frequently asked questions regarding the recent surge in inflation, exploring its causes and consequences.

Question 1: What are the primary causes of the current inflation surge?

The inflation surge is primarily attributed to a complex interplay of factors, including supply chain disruptions caused by the COVID-19 pandemic, soaring energy prices, and increased consumer demand amidst economic recovery.

Understanding Atherosclerosis: Causes, Consequences, and Management - Source calbizjournal.com

Question 2: How does inflation impact individuals and businesses?

Inflation erodes the purchasing power of individuals, reducing the value of their savings and increasing the cost of living. For businesses, inflation may lead to higher input costs, potentially affecting profitability and competitiveness.

Question 3: What measures can governments take to address inflation?

Governments typically employ monetary and fiscal policies to combat inflation. Monetary authorities may raise interest rates to curb spending and slow economic growth. Fiscal measures may involve reducing government spending or increasing taxes to reduce aggregate demand.

Question 4: What are the potential long-term consequences of persistent inflation?

Persistent inflation can lead to a decline in economic growth, reduced investment, and social unrest. It can erode trust in the financial system and make it difficult for individuals to plan for the future.

Question 5: How can individuals protect themselves from the effects of inflation?

Individuals can consider investing in inflation-linked assets, such as Treasury Inflation-Protected Securities (TIPS) or commodities. They can also negotiate for salary increases that keep pace with inflation and minimize unnecessary spending.

Question 6: What is the outlook for inflation going forward?

The outlook for inflation remains uncertain. While some economists believe it will gradually subside as supply chain issues resolve, others predict it may persist for an extended period due to structural factors and geopolitical tensions.

In conclusion, understanding the causes and consequences of inflation is crucial for informed decision-making. The information provided in this FAQ section empowers individuals and businesses to navigate the complexities of inflation.

To learn more about inflation and its implications, refer to the next article section.

Tips

To fully grasp the complexities of inflation, it's imperative to delve into Inflation Surges: Understanding The Causes And Consequences, an insightful resource that unpacks its causes and ramifications.

Tip 1: Keep Pace with Economic Indicators

Stay abreast of key economic indicators, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), which offer invaluable insights into inflation trends. Monitoring these metrics enables businesses and individuals to adjust strategies and adapt to changing market conditions.

Tip 2: Diversify Investments

To mitigate the impact of inflation on investment portfolios, consider diversifying assets across various sectors and asset classes. This strategy enhances resilience and reduces the risk of significant losses due to inflation-driven market fluctuations.

Tip 3: Reassess Long-term Debt

Inflation can erode the real value of long-term debt, potentially increasing the burden on borrowers. Evaluate current financing arrangements and consider refinancing options with fixed interest rates to minimize the impact of inflation on debt servicing costs.

Tip 4: Adjust Pricing Strategies

Businesses may need to adjust pricing strategies to counterbalance rising input costs and maintain profitability. However, balancing the need for price increases with market demand and competition requires careful consideration.

Tip 5: Review Contracts and Agreements

Inflation can alter the terms of contracts and agreements that include price or cost adjustments. Regularly review existing agreements to ensure they reflect current inflation trends and protect all parties involved.

Understanding and addressing the impacts of inflation requires proactive measures. By implementing these tips, businesses and individuals can navigate challenges, capitalize on opportunities, and mitigate the risks associated with inflationary periods.

Inflation Surges: Understanding The Causes And Consequences

Inflation, a persistent rise in the general price level, has escalated significantly, necessitating an exploration of the underlying causes and potential consequences.

- Monetary Expansion: Excessive printing of money increases the supply, reducing its value and raising prices.

- Supply Chain Disruptions: Obstacles in production and distribution networks create shortages, driving prices up.

- Rising Energy Costs: Increased demand and geopolitical tensions push energy prices higher, impacting production and transportation.

- Wage Pressures: Labor shortages and higher living expenses exert upward pressure on wages, increasing labor costs and, consequently, prices.

- Government Spending: Large-scale government expenditures inject money into the economy, potentially leading to inflation.

- Demand-Driven Inflation: High consumer demand, often fueled by low interest rates, can outpace supply, causing prices to escalate.

These aspects highlight the complex interplay of factors contributing to inflation. Monetary expansion, supply chain disruptions, rising energy costs, wage pressures, government spending, and demand-driven inflation are interconnected and can lead to a persistent increase in the price level, affecting various economic sectors and individuals.

SOLUTION: Inflation- Causes of Inflation: and Explanation of Inflation - Source www.studypool.com

Understanding Power Surges: Causes, Prevention, and Impacts on Your - Source calderapowerservices.com

Inflation Surges: Understanding The Causes And Consequences

Inflation is a persistent increase in the general price level of goods and services over time, reducing the purchasing power of money. Understanding the causes and consequences of inflation surges is critical for policymakers, economists, and individuals to make informed decisions and mitigate their impact on the economy and society.

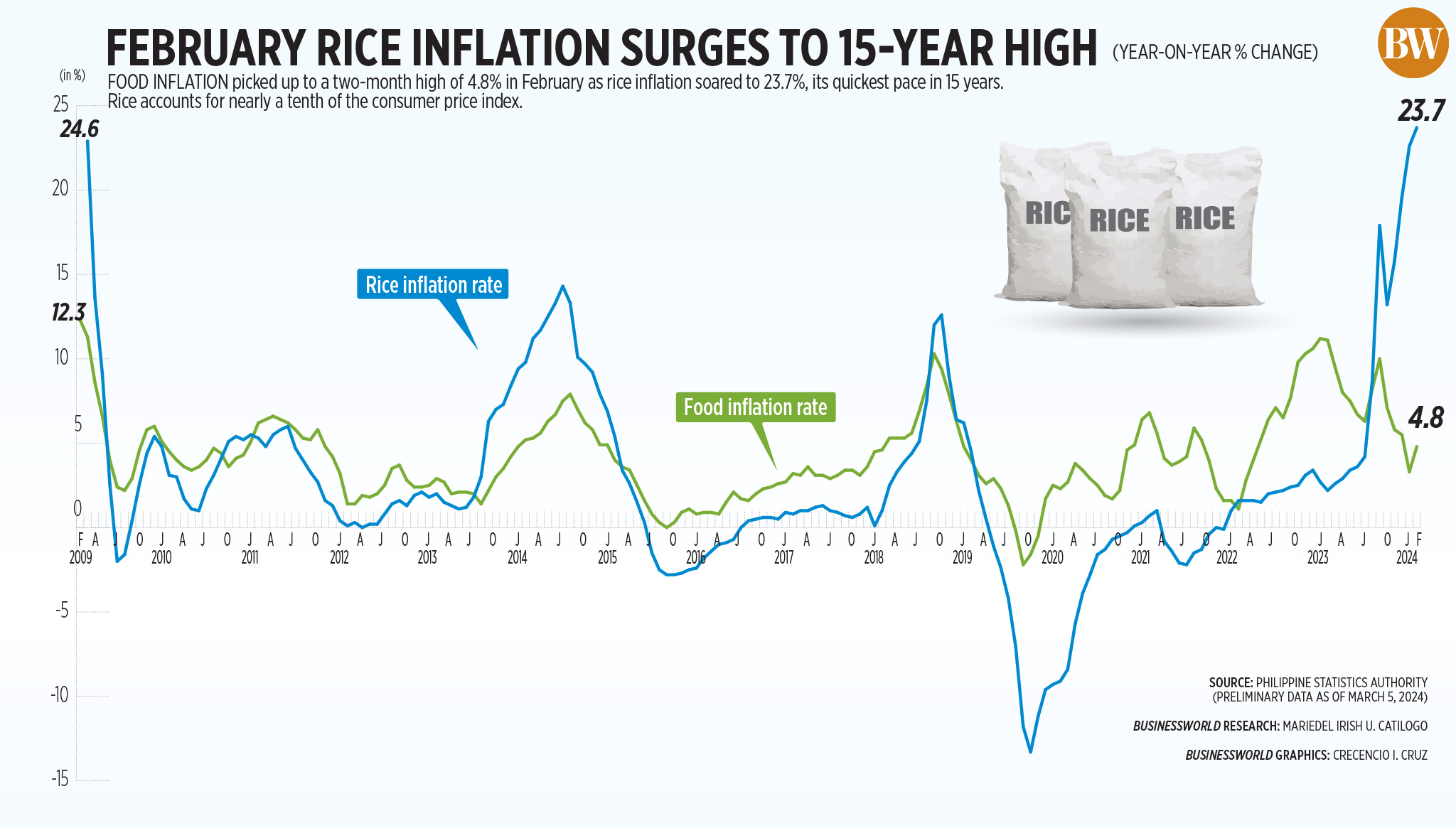

February rice inflation surges to 15-year high - BusinessWorld Online - Source www.bworldonline.com

Inflation can result from various factors, including demand-pull inflation, cost-push inflation, and monetary inflation. Demand-pull inflation occurs when aggregate demand exceeds the economy's productive capacity, leading to higher prices. Cost-push inflation arises when production costs increase due to factors such as rising wages, higher raw material prices, or supply chain disruptions. Monetary inflation occurs when the money supply grows faster than the economy's output, increasing the amount of money chasing a limited supply of goods and services.

The consequences of inflation surges can be severe. High inflation erodes the value of savings, reduces the purchasing power of income, and can lead to social unrest. It can also distort investment decisions, as businesses may hesitate to invest in long-term projects due to uncertainty about future costs and returns. Additionally, inflation can make it difficult for central banks to control the economy, as they may need to raise interest rates to curb inflation, potentially slowing economic growth.

Mitigating the impact of inflation surges requires a multifaceted approach. Central banks play a crucial role by managing the money supply and interest rates to control inflation. Fiscal policy measures, such as adjusting government spending and taxation, can also influence inflation. Additionally, supply-side policies aimed at increasing productivity and reducing production costs can help ease inflationary pressures.

Understanding the causes and consequences of inflation surges is essential for policymakers, economists, and individuals to make informed decisions. By addressing the root causes of inflation and implementing appropriate measures, it is possible to mitigate its negative effects and promote economic stability and growth.

Table: Causes and Consequences of Inflation Surges

| Causes | Consequences |

|---|---|

| Demand-pull inflation | Higher prices, reduced purchasing power |

| Cost-push inflation | Increased production costs, lower profits |

| Monetary inflation | Erosion of savings, distorted investment decisions |

Super Bowl LVI: The Epic Clash Between The Los Angeles Rams And Cincinnati Bengals, NBIS Stock: A Comprehensive Analysis Of Performance And Potential, Jenna Lyons: The Visionary Behind J.Crew And Female Empowerment In Fashion, F. Murray Abraham: Academy Award-Winning Actor And Hollywood Icon, Devils And Canadiens Battle In Newark For Eastern Dominance, Discover A Hidden Gem: Unforgettable Adventures With Apga Tours, Exceptional Doral Florida: Uncover Your Oasis In The Heart Of Miami's Suburbia, Penn State Nittany Lions Vs. Iowa Hawkeyes: Big Ten Football Showdown, Al Harris: Legendary NFL Cornerback And Super Bowl Champion, Witness The Web-Slinging Adventures Of Spider-Man: A Marvelous Superhero Saga,