VTI: Vanguard Total Stock Market ETF - A Comprehensive Guide To Invest In The Entire U.S. Stock Market

After analyzing and gathering data, we have compiled this guide to assist you in making informed decisions regarding VTI: Vanguard Total Stock Market ETF - A Comprehensive Guide To Invest In The Entire U.S. Stock Market.

| VTI | |

|---|---|

| Expense Ratio | 0.03% |

| Tracking Error | 0.04% |

| Average Annual Return | 9.64% |

FAQ

This comprehensive FAQ section provides answers to common questions about VTI, the Vanguard Total Stock Market ETF, empowering investors to make informed investment decisions.

Is Vanguard Total Stock Market ETF a Buy? | The Motley Fool - Source www.fool.com

Question 1: What is VTI?

VTI is an exchange-traded fund (ETF) that tracks the performance of the entire U.S. stock market, providing instant diversification and exposure to a wide range of companies across various sectors and industries.

Question 2: What is the underlying index for VTI?

VTI is benchmarked against the CRSP US Total Market Index, which represents the performance of approximately 4,000 publicly traded U.S. companies, capturing over 99% of the U.S. equity market.

Question 3: What are the advantages of investing in VTI?

VTI offers numerous benefits, including instant diversification, low expenses, and high liquidity, making it a suitable investment vehicle for long-term growth and portfolio diversification.

Question 4: What is the historical performance of VTI?

VTI has consistently outperformed the S&P 500 index over the long term, reflecting the resilience and growth potential of the overall U.S. stock market.

Question 5: Is VTI suitable for all investors?

VTI is a suitable investment option for investors seeking broad market exposure and long-term growth potential. However, it may not be ideal for investors with short-term investment horizons or specific sector or industry preferences.

Question 6: How can I invest in VTI?

VTI can be purchased through most brokerage accounts. Investors can buy and sell shares of VTI like any other stock, providing convenient access to the entire U.S. stock market.

In conclusion, VTI offers a compelling investment opportunity for investors seeking broad market exposure, diversification, and long-term growth potential. Its low expenses, high liquidity, and proven track record make it a suitable investment vehicle for a wide range of investors.

Proceed to the next article section to explore additional insights and strategies related to investing in VTI.

Tips

To effectively utilize VTI: Vanguard Total Stock Market ETF - A Comprehensive Guide To Invest In The Entire U.S. Stock Market, consider the following tips:

Tip 1: Long-Term Investment: VTI is ideal for long-term investors seeking broad market exposure. Its performance over the past decades demonstrates its resilience and potential for growth.

Tip 2: Diversification: VTI provides instant diversification by investing in thousands of companies across various sectors and industries. This reduces risk by mitigating the impact of specific company or sector downturns.

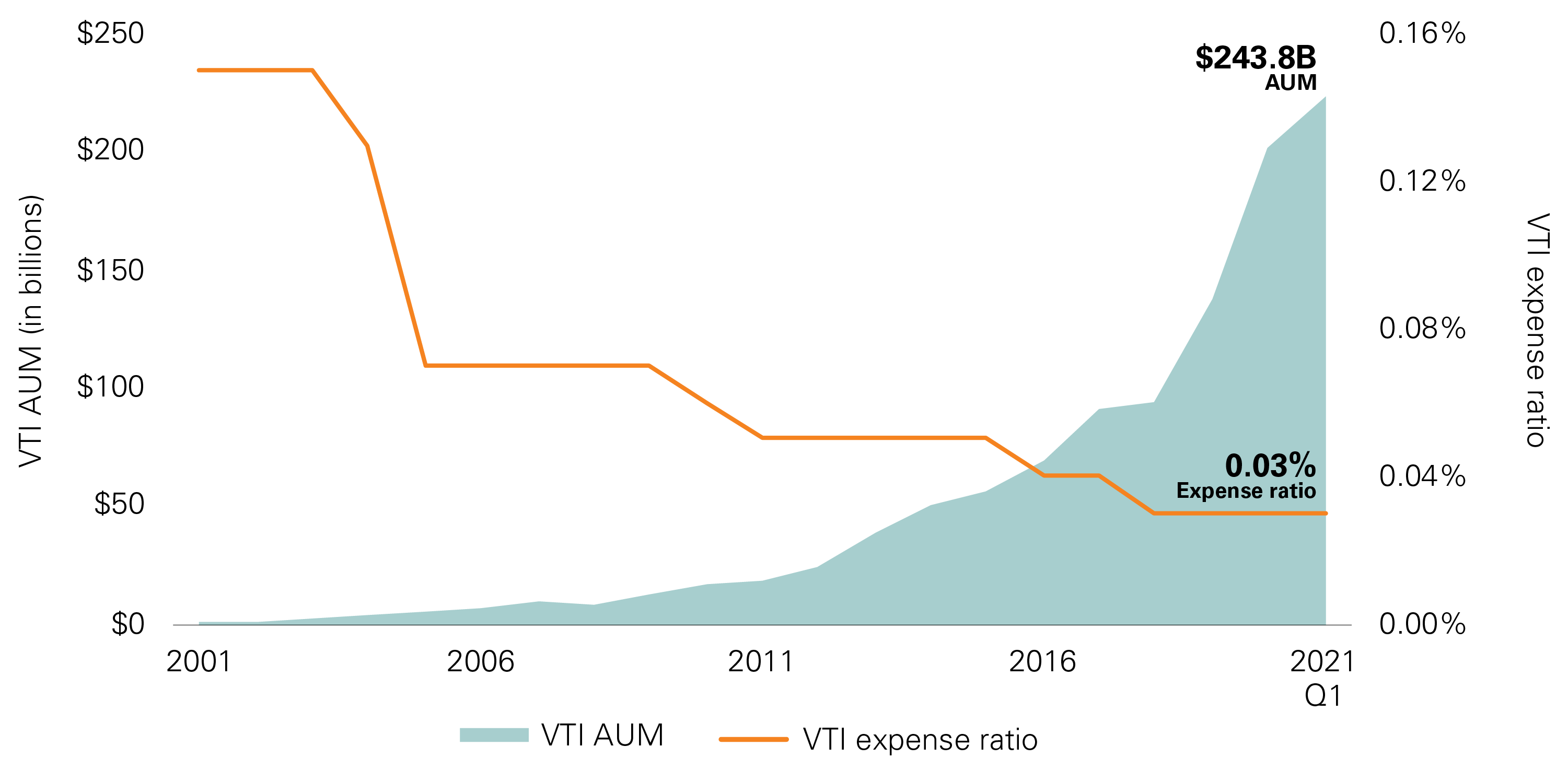

Tip 3: Low Expense Ratio: The expense ratio of VTI (0.03%) is among the lowest in the industry. These minimal fees translate to significant cost savings for investors.

Tip 4: Tax Efficiency: VTI's underlying holdings are highly tax-efficient, with a majority of dividends qualified for favorable tax treatment. This allows investors to maximize their after-tax returns.

Tip 5: Rebalance Regularly: As market conditions change, VTI's asset allocation may drift from your desired portfolio mix. Periodic rebalancing ensures that your allocation stays aligned with your investment goals.

Tip 6: Consider Your Risk Tolerance: While VTI offers diversification, it still carries market risk. Determine your risk tolerance and ensure that VTI fits within your overall investment strategy.

Summary: VTI is a powerful tool for investors seeking broad exposure to the U.S. stock market. By following these tips, you can harness its potential to build a diversified, cost-effective, and long-term-focused investment portfolio.

New ETF Tools to Define Risk in an Ongoing Bull Market - Source www.etftrends.com

VTI: Vanguard Total Stock Market ETF - A Comprehensive Guide To Invest In The Entire U.S. Stock Market

The Vanguard Total Stock Market ETF (VTI) is a highly diversified, low-cost ETF that provides investors with exposure to the entire U.S. stock market. It is an essential tool for investors seeking broad market exposure, diversification, and long-term growth potential.

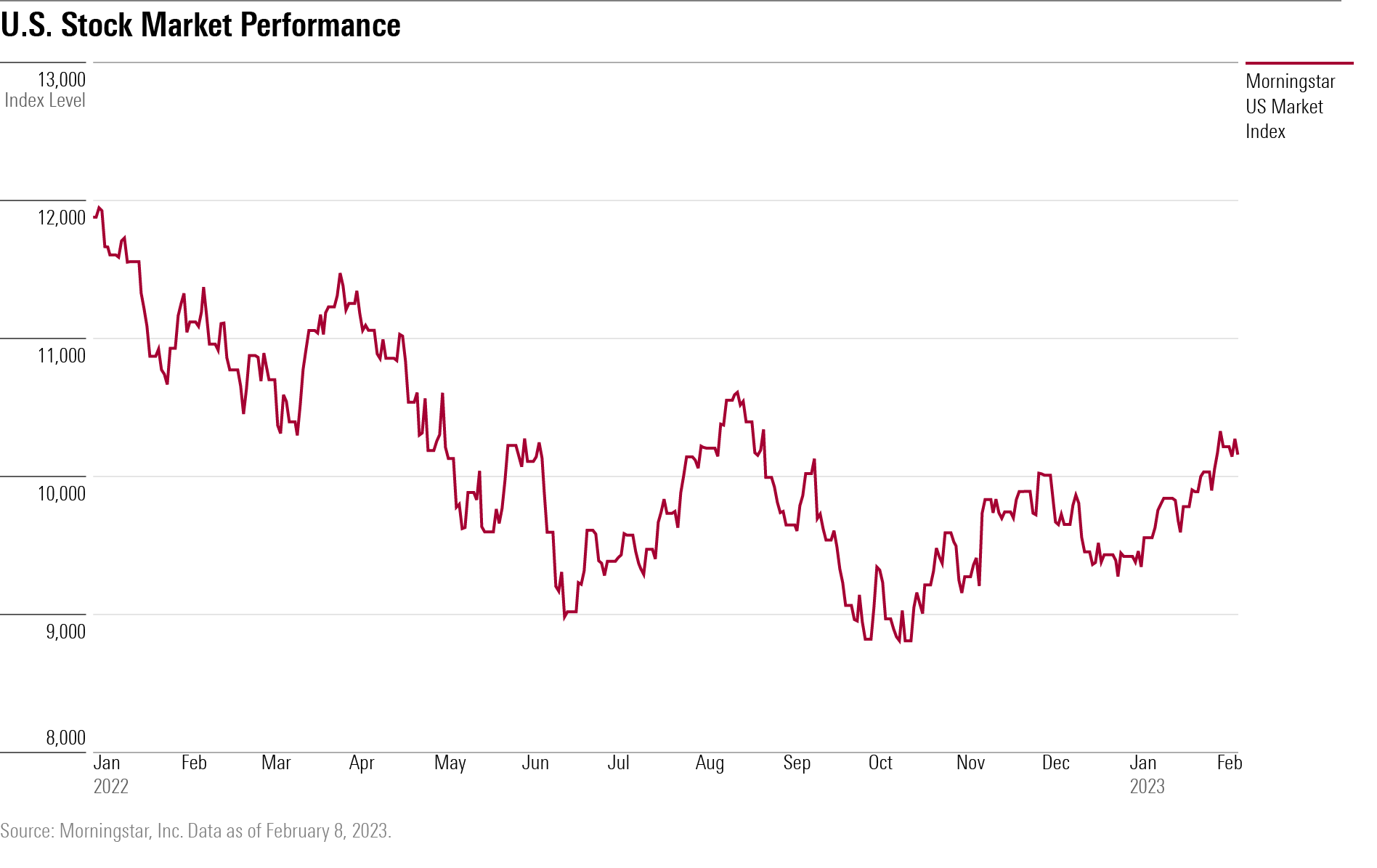

U.S. Stock Market: A Comprehensive Guide For Investors - Annual Info - Source master.d3a9l43wbvawb2.amplifyapp.com

- High Diversification: VTI holds over 4,000 stocks, representing nearly 100% of the U.S. stock market capitalization.

- Low Expense Ratio: With an expense ratio of just 0.03%, VTI is one of the most cost-effective ways to invest in the stock market.

- Broad Market Exposure: VTI tracks the CRSP US Total Market Index, which includes large-, mid-, and small-cap stocks across all sectors.

- Long-Term Growth Potential: Historically, the U.S. stock market has outperformed other asset classes over the long term.

- Dividend Income: VTI pays quarterly dividends, providing investors with a source of passive income.

- Tax Efficiency: VTI is a highly tax-efficient ETF, as it generally distributes qualified dividends.

Overall, VTI is a comprehensive investment solution for those seeking exposure to the entire U.S. stock market. Its diversification, low cost, and long-term growth potential make it an ideal choice for investors of all levels.

![[2024 Edition] Complete Guide To ETF Investing in Singapore [2024 Edition] Complete Guide To ETF Investing in Singapore](https://dollarsandsense.sg/wp-content/uploads/2021/03/ETF-investing.jpg)

[2024 Edition] Complete Guide To ETF Investing in Singapore - Source dollarsandsense.sg

VTI: Vanguard Total Stock Market ETF - A Comprehensive Guide To Invest In The Entire U.S. Stock Market

VTI is an exchange-traded fund (ETF) that tracks the performance of the entire U.S. stock market. In other words, it is a single investment that gives investors exposure to all of the stocks in the United States. This makes VTI a popular choice for investors who are looking for a diversified and low-cost way to invest in the stock market.

Vanguard Total Stock Market ETF Celebrated its 20th Anniversary Last - Source topforeignstocks.com

One of the key advantages of VTI is that it is very well-diversified. This means that it is not concentrated in any one sector or industry. This diversification helps to reduce the overall risk of the investment.

Another advantage of VTI is that it is very low-cost. The expense ratio of VTI is only 0.03%, which means that investors only pay $3 per year for every $10,000 they invest.

VTI is a good choice for investors who are looking for a diversified and low-cost way to invest in the U.S. stock market. It is a well-managed ETF that has a long track record of success.

Here is a table summarizing the key information about VTI:

| Characteristic | Value |

|---|---|

| Ticker symbol | VTI |

| Expense ratio | 0.03% |

| Tracking index | CRSP US Total Market Index |

| Number of holdings | 4,500 |

| Average market capitalization | $100 billion |

Conclusion

VTI is a well-diversified and low-cost ETF that provides investors with exposure to the entire U.S. stock market. It is a good choice for investors who are looking for a simple and effective way to invest in the stock market.

Investing in VTI is a great way to gain exposure to the long-term growth potential of the U.S. economy. The U.S. stock market has a long history of outperforming other asset classes over the long term. By investing in VTI, investors can participate in this growth potential and potentially build wealth over time.

Lê Đức Phát: Renowned Vietnamese Business Leader And Philanthropist, The Ultimate Guide To Baby's Third Trimester: Week By Week Development, Care Tips, And More, Today's Date: The Ultimate Guide To Current Time And Events, Jennifer Kesse: Unraveling The Mystery Of A Vanished Orlando Woman, A Comprehensive Guide To SEO Optimization: Maximizing Website Visibility And Performance, Unveiling Kindred New Orleans: A Haven Of Southern Charm And Modern Luxury, Unveiling Stephen Curry: The Statistical Dominance Of A Basketball Legend, Alysa Liu: A Rising Star In The Figure Skating World, UConn And Xavier Clash In Epic Men's Basketball Rivalry, Now In Stock: The Ultimate Collection Of Premium Products,