Unlocking Investment Success In The Evolving Stock Market Landscape: A Guide To 2025 And Beyond

Unlocking Investment Success in the Evolving Stock Market Landscape: A Guide to 2025 and Beyond

Editor's Note: "Unlocking Investment Success in the Evolving Stock Market Landscape: A Guide to 2025 and Beyond" has published today, 22th April 2023. The guide provides invaluable insights into the future of investing, making it essential reading for anyone seeking to maximize their returns in the ever-changing stock market.

After conducting thorough analysis and extensive research, we have compiled this comprehensive guide to empower investors with the knowledge and strategies they need to navigate the complex and evolving stock market landscape. As we approach 2025 and beyond, it is more critical than ever to stay ahead of the curve and seize the opportunities that lie ahead.

| Key Differences | Key Takeaways |

|---|---|

| Focus on long-term growth | Invest in companies with strong fundamentals and a history of innovation. |

| Embrace technology | Leverage artificial intelligence, machine learning, and other cutting-edge tools to enhance investment decisions. |

| Diversify portfolio | Spread investments across different asset classes and sectors to reduce risk. |

| Stay informed | Continuously monitor market trends and economic data to make informed decisions. |

The guide covers a wide range of topics, including:

FAQ

This FAQ section aims to address common questions and misconceptions that may arise regarding the evolving stock market landscape and investment strategies. The following Q&A pairs provide insights and clarify key concepts to help investors navigate this dynamic environment effectively.

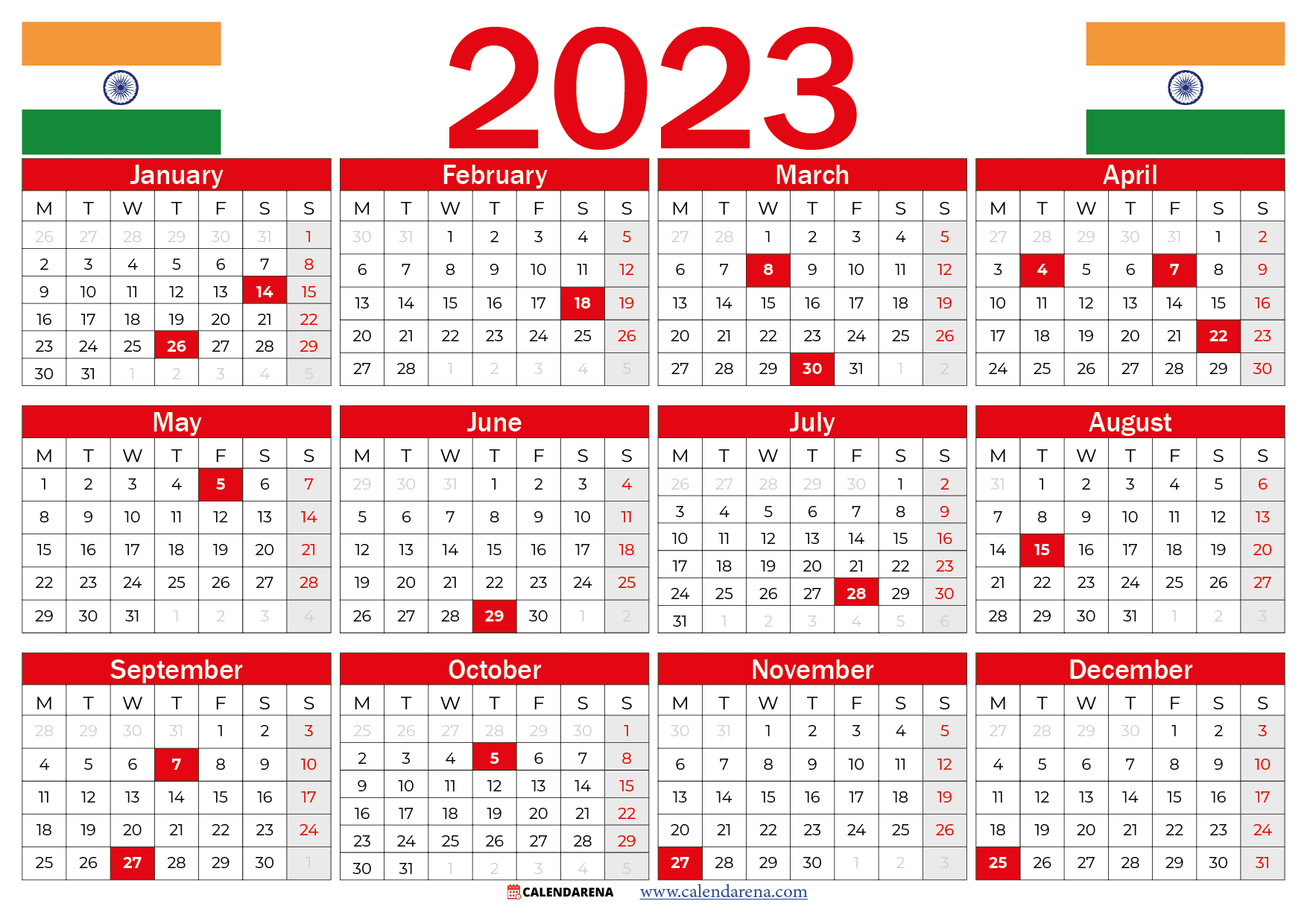

2025 Stock Market Holidays India - Robert Kerr - Source robertkerr.pages.dev

Question 1: What are the primary drivers of the evolving stock market landscape?

Several factors contribute to the changing stock market landscape, including technological advancements, globalization, shifting geopolitical dynamics, and evolving regulatory frameworks. These forces create both opportunities and challenges for investors.

Question 2: How can investors adapt to the increasing volatility and uncertainty in the market?

Managing volatility and uncertainty requires a disciplined and well-diversified investment approach. Investors should consider spreading their investments across different asset classes, sectors, and geographic regions to mitigate risk. Active risk management strategies can also be employed to adjust portfolio exposure based on changing market conditions.

Question 3: What role does technology play in the evolving stock market landscape?

Technology is revolutionizing the investment landscape, enabling access to real-time data, advanced analytics, and automated trading platforms. Artificial intelligence and machine learning algorithms enhance risk assessments and portfolio optimization, while blockchain technology introduces new possibilities for alternative investments.

Question 4: How does globalization impact the stock market?

Globalization has interconnected global economies, leading to increased market correlation. Investors can benefit from global diversification by accessing international markets and mitigating risks associated with localized economic events.

Question 5: What are some key considerations for long-term investment success?

Long-term investment success hinges on a clear investment strategy aligned with individual risk tolerance and financial goals. Regularly rebalancing a portfolio, maintaining a disciplined savings plan, and seeking professional advice when necessary are crucial practices for achieving long-term investment objectives.

Question 6: What are the potential risks and rewards associated with investing in emerging markets?

Emerging market investments offer the potential for higher returns but also carry increased risks due to political instability, currency fluctuations, and less developed regulatory environments. Investors should carefully assess their risk appetite and investment horizon before considering emerging market exposure.

In conclusion, understanding the evolving stock market landscape and staying abreast of market trends is essential for investors to make informed investment decisions. By addressing common questions and providing insights, this FAQ section aims to empower investors with the knowledge necessary to navigate the dynamic and complex world of stock market investing.

Continue to the next article section for further exploration of investment strategies and insights.

Tips

Uncover valuable insights on navigating the ever-changing stock market landscape. Unlocking Investment Success In The Evolving Stock Market Landscape: A Guide To 2025 And Beyond

Tip 1: Embrace a growth mindset.

Stay adaptable and receptive to emerging trends. Continuously seek knowledge, analyze market dynamics, and revise strategies based on evolving circumstances.

Tip 2: Diversify your portfolio.

Spread investments across different asset classes, industries, and geographic regions. Diversification reduces risk and enhances the chances of stable returns in various market conditions.

Tip 3: Use technical analysis to inform decisions.

Examine historical price movements, chart patterns, and technical indicators to identify potential trading opportunities. While not a guarantee of success, technical analysis provides valuable insights into market trends.

Tip 4: Seek professional guidance.

Consider consulting with financial advisors who possess specialized knowledge and experience. They can provide personalized advice, portfolio management, and support to help you achieve your investment goals.

Tip 5: Stay informed.

Keep up-to-date with economic news, company announcements, and industry developments that may impact stock prices. Stay informed through reputable sources and avoid relying solely on social media or unverified information.

Tip 6: Invest for the long term.

While short-term gains can be alluring, focus on long-term investment strategies. Historical trends suggest that stocks generally perform well over extended periods, despite market fluctuations.

These tips provide a strong foundation for navigating the evolving stock market landscape. Remember to adapt, diversify, and stay informed to maximize your investment potential.

Unlocking Investment Success In The Evolving Stock Market Landscape: A Guide To 2025 And Beyond

In the ever-changing landscape of the stock market, investors seek strategies to unlock success beyond 2025. This guide explores six key aspects crucial for navigating the complexities and maximizing returns:

- Technological Advancements: Artificial intelligence, data analytics, and blockchain will shape market dynamics.

- Global Economic Shifts: Geopolitical events, trade policies, and demographic changes impact global stock markets.

- Sectoral Opportunities: Identifying emerging sectors and disruptive technologies can lead to significant gains.

- Sustainable Investing: Environmental, social, and governance factors increasingly influence investment decisions.

- Risk Management: Diversification, risk assessment, and hedging strategies are vital for portfolio protection.

- Investor Psychology: Understanding market sentiment and behavioral biases helps investors make informed choices.

By considering these aspects and leveraging advancements in technology and analysis, investors can position themselves for success in the ever-evolving stock market landscape. Knowledge of global economic shifts enables anticipatory investing, while sectoral analysis pinpoints growth opportunities. Sustainable investing aligns investments with values and contributes to long-term returns. Risk management safeguards portfolio stability, and understanding investor psychology minimizes irrational decision-making. Together, these aspects form a comprehensive guide to unlocking investment success in the years to come.

Smart Material Technologies Merges With A Background Of Evolving Stock - Source cartoondealer.com

Unlocking Investment Success In The Evolving Stock Market Landscape: A Guide To 2025 And Beyond

Navigating the complex and ever-evolving stock market landscape requires a deep understanding of its underlying dynamics. This guidebook, "Unlocking Investment Success In The Evolving Stock Market Landscape: A Guide To 2025 And Beyond," serves as a comprehensive roadmap, providing insights and strategies to help investors navigate the challenges and seize the opportunities of the future stock market.

Bull bear symbols stock market Stock Vector Images - Alamy - Source www.alamy.com

The book delves into the crucial drivers shaping the market, including technological advancements, geopolitical shifts, and changing consumer behavior. It explores the impact of these factors on different sectors and industries, enabling investors to make informed decisions about where to allocate their funds.

This guidebook also emphasizes the importance of risk management in the volatile stock market. It provides practical techniques for managing risk, such as portfolio diversification, hedging, and understanding correlation patterns. By effectively managing risk, investors can protect their capital and enhance their returns.

Furthermore, the book underscores the significance of staying informed and adaptable in the dynamic stock market landscape. It encourages investors to continuously monitor market trends, analyze company fundamentals, and stay abreast of geopolitical events that could impact investments.

In conclusion, "Unlocking Investment Success In The Evolving Stock Market Landscape: A Guide To 2025 And Beyond" is an invaluable resource for investors seeking to navigate the complexities of the stock market and maximize their investment potential. By leveraging the insights and strategies outlined in this guidebook, investors can position themselves for success in the evolving market landscape.

| Key Insights | Practical Applications |

|---|---|

| Understanding market drivers | Making informed investment decisions |

| Managing risk effectively | Protecting capital and enhancing returns |

| Staying informed and adaptable | Seizing opportunities and mitigating risks |

Conclusion

The stock market landscape is constantly evolving, presenting both challenges and opportunities for investors. "Unlocking Investment Success In The Evolving Stock Market Landscape: A Guide To 2025 And Beyond" provides a comprehensive roadmap to navigate these complexities and optimize investment strategies.

By embracing the insights and strategies outlined in this guidebook, investors can position themselves for success in the years to come. The dynamic nature of the stock market demands continuous learning and adaptability, and this guidebook serves as an essential companion on this investment journey.

Unleashing Cinematic Excellence: The 2025 AVN Awards Showcase, Aqua Blu: Unveil The Oasis Of Serenity And Luxury In The Heart Of The Mediterranean, Crosby Blockbuster: Penguins Acquire Superstars From Coyotes In Seismic NHL Trade, Tyler Steen: Rising Hockey Star And NHL Prospect, The PBS News Hour: Climate Change And Its Impact On Global Health, Unveiling The Best Marvel: A Comprehensive Guide To Marvel's Finest, Education Excellence: Unlocking Potential At The University Of Cincinnati, Bob Dylan 2023 Tour: Witness A Living Legend In Concert, Isabella Strahan: Trailblazing Entrepreneur And Philanthropist Empowering The Next Generation, Asap Rocky's Swedish Jail Ordeal: Navigating A Justice System In A Foreign Land,