Unlock Value With ServiceNow Stock: A Comprehensive Guide To Performance And Growth

Looking to maximize your returns with ServiceNow stock? Discover the secrets to unlocking its full value in "Unlock Value With ServiceNow Stock: A Comprehensive Guide To Performance And Growth." This guide empowers investors with expert insights, data-driven analysis, and actionable strategies.

Editor's Notes: "Unlock Value With ServiceNow Stock: A Comprehensive Guide To Performance And Growth" published today provides crucial information for investors seeking to navigate the complexities of the stock market and make informed decisions about their investments.

After extensive analysis and research, we've compiled this comprehensive guide to help investors understand ServiceNow's performance, growth potential, and key investment strategies. By providing a clear roadmap to success, this guide empowers investors to make informed decisions that can unlock the full value of their ServiceNow stock portfolio.

| Key Differences | Key Takeaways |

|---|---|

| Performance Analysis | In-depth analysis of ServiceNow's historical financial performance, revenue growth, and profitability metrics. |

| Growth Potential | Expert insights on ServiceNow's market position, industry trends, and future growth opportunities. |

| Investment Strategies | Practical guidance on investment strategies, including buy-and-hold, value investing, and growth investing. |

Delving into the intricacies of ServiceNow's business model, competitive landscape, and industry outlook, this guide provides investors with a comprehensive understanding of the factors driving the company's success and growth potential.

FAQ

This article provides a comprehensive analysis of ServiceNow stock performance, growth drivers, and key factors influencing its value. The following FAQs aim to address common questions and concerns related to ServiceNow's stock, ensuring a well-rounded understanding for investors.

Performance Measurement and Analytics - Customer Success - ServiceNow - Source www.servicenow.com

Question 1: What is ServiceNow's business model and how does it generate revenue?

ServiceNow is a cloud-based software-as-a-service (SaaS) provider that offers a platform for enterprise businesses to manage their digital workflows and operations. Its revenue model primarily consists of subscription fees from its SaaS platform, where customers pay on an annual basis for access to its software and services.

Question 2: How has ServiceNow's stock performed historically and what factors have influenced its growth?

ServiceNow's stock has performed exceptionally well in recent years, with consistent growth in share price and market capitalization. Key factors driving this growth include its innovative platform, strong customer base, and expanding market opportunities in the enterprise software sector.

Question 3: What are the key drivers of future growth for ServiceNow?

ServiceNow's future growth prospects are expected to be driven by several factors, including the increasing adoption of cloud-based platforms, the growing demand for digital workflow automation, and its continued expansion into new markets and industries.

Question 4: Are there any risks or challenges that could impact ServiceNow's stock performance?

While ServiceNow has a strong track record, there are certain risks that could potentially impact its stock performance, such as competition from other SaaS providers, macroeconomic factors, and regulatory changes in the technology sector.

Question 5: What is the fair value of ServiceNow's stock based on current market conditions?

Determining the fair value of ServiceNow's stock involves considering a range of factors, including its historical performance, future growth prospects, and industry benchmarks. Analysts use various valuation methods to estimate a fair value range, which can fluctuate over time.

Question 6: Is ServiceNow stock a good investment for long-term growth?

Whether ServiceNow stock is a good investment for long-term growth depends on an investor's individual risk tolerance, investment horizon, and assessment of the company's prospects. ServiceNow has demonstrated strong fundamentals and a compelling growth story, but it's important to conduct thorough research and consider potential risks before making an investment decision.

By addressing these frequently asked questions, investors can gain a deeper understanding of ServiceNow's stock and make informed decisions based on the available information.

Moving forward, it is essential to stay abreast of the latest news, financial reports, and market analysis to make informed decisions regarding ServiceNow's stock.

Tips

To maximize your returns and unlock the value of ServiceNow stock, consider these insightful tips:

Tip 1: Unlock Value With ServiceNow Stock: A Comprehensive Guide To Performance And Growth, a valuable resource that provides comprehensive insights into the company's performance and growth trajectory.

Tip 2: Diligently research the industry landscape, competitive dynamics, and ServiceNow's position within them. Understanding the company's competitive advantages and potential risks is crucial for informed decision-making.

Tip 3: Monitor ServiceNow's financial performance closely, examining revenue growth, profitability metrics, and cash flow. Assess the company's ability to generate sustainable growth and profitability.

Tip 4: Evaluate ServiceNow's product offerings, market share, and customer base. Consider the company's innovation pipeline and its ability to adapt to evolving market trends.

Tip 5: Consider ServiceNow's management team, their track record, and their vision for the company's future. Assess the leadership's ability to execute strategic initiatives and drive growth.

Tip 6: Monitor analyst recommendations and market sentiment towards ServiceNow stock. While not a substitute for independent analysis, these perspectives can provide valuable insights into market sentiment.

Tip 7: Leverage online resources and discussion forums to connect with other investors and gain diverse perspectives on ServiceNow's stock performance.

Summary

By following these tips, investors can gain a deeper understanding of ServiceNow's stock, make informed investment decisions, and maximize their potential returns. Remember to conduct thorough research, monitor the company's performance, and consult with financial advisors to align your investment strategy with your financial goals.

Unlock Value With ServiceNow Stock: A Comprehensive Guide To Performance And Growth

Unlocking value with ServiceNow stock entails a thorough examination of crucial aspects that drive its performance and growth trajectory. These six key aspects provide a comprehensive framework for analyzing the company's potential and making informed investment decisions.

- Financial Strength: ServiceNow's financial health, including revenue growth, profitability, and cash flow, provides insights into its financial stability and capacity for future growth.

- Market Leadership: ServiceNow's position as a market leader in cloud-based IT service management software signifies its technological advantage and potential for sustained market dominance.

- Customer Base: The size, diversity, and retention rate of ServiceNow's customer base indicate the company's ability to attract and retain a loyal client base.

- Product Innovation: ServiceNow's commitment to research and development, as well as its track record of introducing innovative products, demonstrates its potential for continued growth and market share expansion.

- Competitive Landscape: Understanding the competitive landscape in which ServiceNow operates, including key competitors, industry trends, and potential disruptors, is essential for assessing its competitive advantage.

- Valuation: A careful analysis of ServiceNow's valuation, considering its financial performance, growth prospects, and industry comparables, helps determine its investment attractiveness relative to other opportunities.

By thoroughly evaluating these key aspects, investors can gain a comprehensive understanding of ServiceNow's strengths, weaknesses, and potential for value creation. This knowledge empowers informed decisions that align with individual investment strategies and risk tolerance, maximizing the potential for unlocking value with ServiceNow stock.

/GettyImages-1158402857-7bb1f36833e44ad496955b8fb2161ffd.jpg)

Value or Growth Stocks: Which Is Better? - Source www.investopedia.com

Unlock Value With ServiceNow Stock: A Comprehensive Guide To Performance And Growth

ServiceNow stock has been a consistent performer, delivering strong returns for investors. The company's focus on digital transformation and its ability to execute on its strategy have been key drivers of its success. In this guide, we will take a comprehensive look at ServiceNow's performance and growth prospects, and we will provide investors with the information they need to make informed decisions about investing in the company.

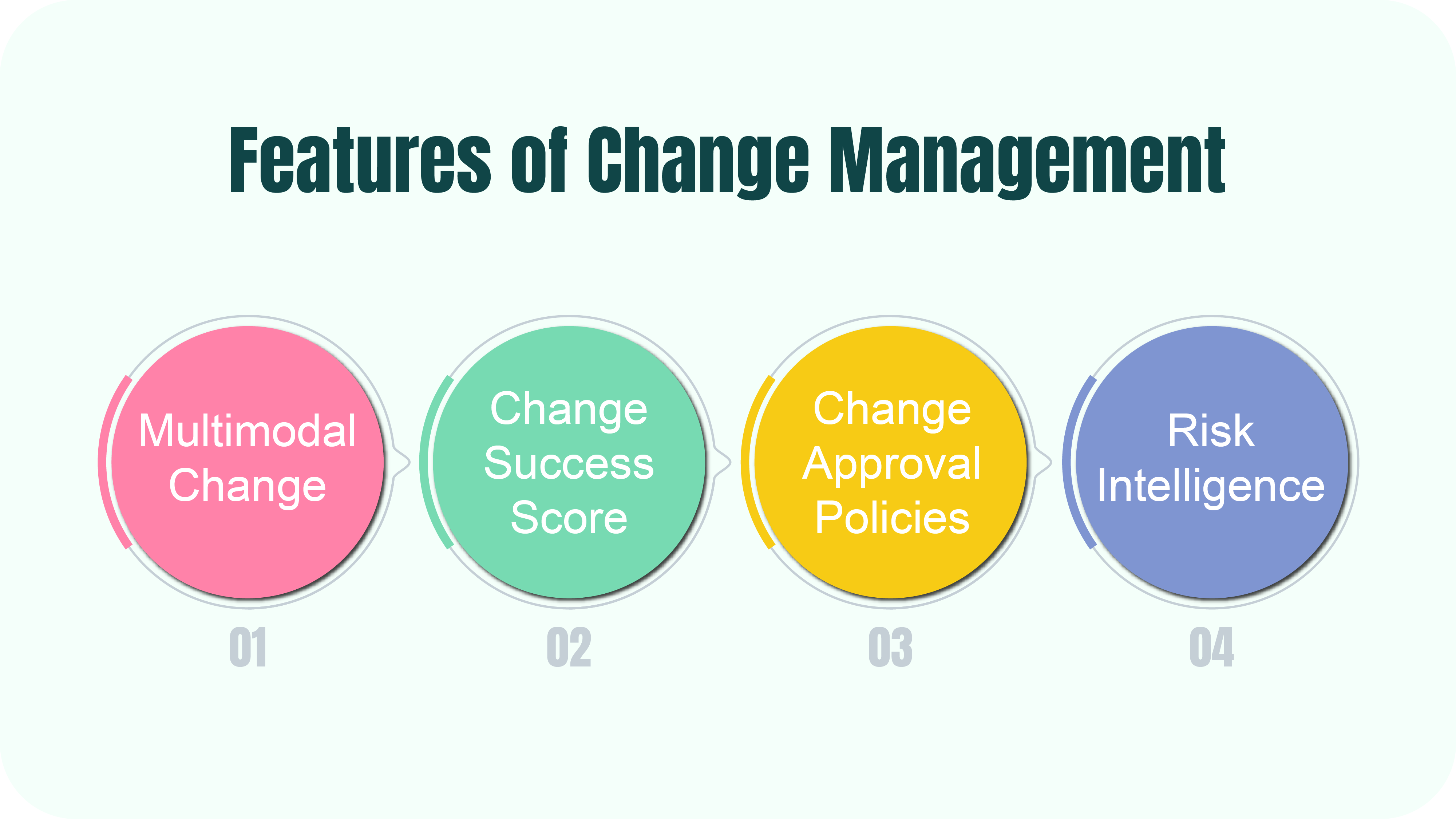

A Comprehensive Guide to ServiceNow Change Management - acSoft Inc - Source www.acsoftinc.com

ServiceNow is a leading provider of cloud-based IT service management (ITSM) solutions. The company's platform helps organizations to automate and streamline their IT operations, improve service delivery, and reduce costs. ServiceNow's customer base includes some of the world's largest and most respected organizations, including Google, Amazon, and Microsoft.

The company's revenue has grown rapidly in recent years, and it is expected to continue to grow at a strong pace in the future. ServiceNow is also profitable, and it has a strong track record of generating cash flow. The company's financial performance is a testament to its strong business model and its ability to execute on its strategy.

ServiceNow is a well-managed company with a strong team of executives. The company's management team has a proven track record of success, and they are committed to delivering long-term value for shareholders. ServiceNow's strong leadership team is another reason why the company is a good investment.

Overall, ServiceNow is a well-positioned company with a strong track record of performance and growth. The company's focus on digital transformation, its strong financial performance, and its well-managed team make it a good investment for investors who are looking for long-term growth.

Conclusion

ServiceNow is a leading provider of cloud-based IT service management (ITSM) solutions. The company's platform helps organizations to automate and streamline their IT operations, improve service delivery, and reduce costs. ServiceNow has a strong track record of performance and growth, and it is expected to continue to grow at a strong pace in the future. The company's focus on digital transformation, its strong financial performance, and its well-managed team make it a good investment for investors who are looking for long-term growth.

Bernie Moreno: Leading Businessman, Political Candidate, And Advocate For Florida's Future, The F-35 Lightning II: Revolutionizing Aerial Combat With Stealth And Supremacy, The Harder They Fall: A Western Redemption With Cynthia Erivo And Idris Elba, Donovan Clingan: Trailblazing Visionary In Cybersecurity, School Closings | Vermont, New Hampshire & New York | WCAX.com, CRM Stock: Driving Business Success And Enhancing Customer Relationships, NIH Funding Freeze: Impact On Biomedical Research And Healthcare, Canada Asylum: A Comprehensive Guide To Seeking Refuge In Canada, Unlocking A Brighter Future: Empowering Young Learners Through Head Start, NBA Champion Andre Iguodala: A Legacy Of Excellence And Leadership,