Senator Crapo: Leading The Charge For Tax Reform And Economic Recovery

Senator Crapo: Leading The Charge For Tax Reform And Economic Recovery

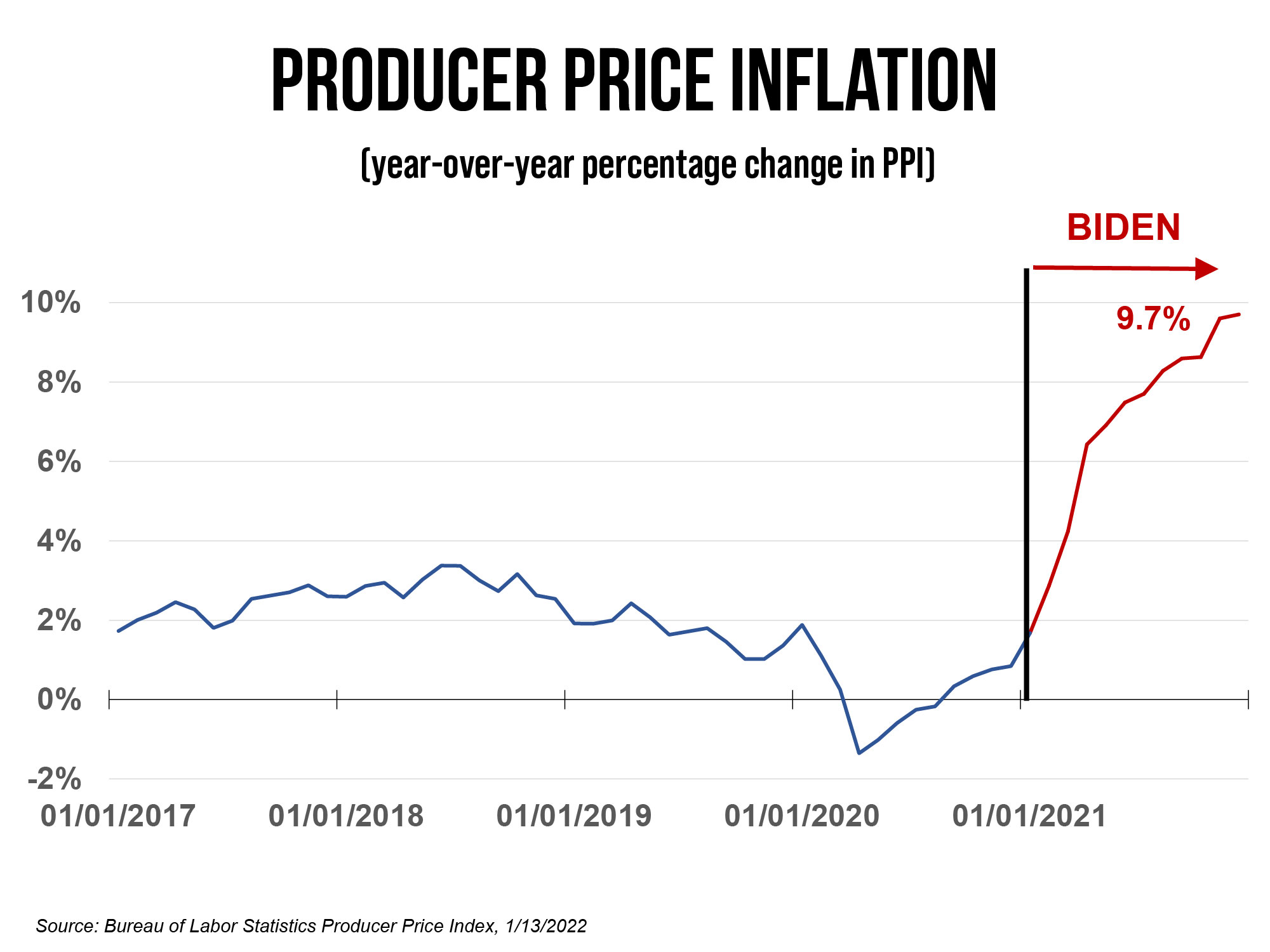

Record-High Inflation Greatest Threat to Economic Recovery | U.S - Source www.crapo.senate.gov

Editor's Notes: "Senator Crapo: Leading The Charge For Tax Reform And Economic Recovery" have published and there are many reasons why it is important to read and understand it.

Our team efforts in senator Crapo's tax reform doing some analysis, digging information, made Senator Crapo: Leading The Charge For Tax Reform And Economic Recovery we put together this Senator Crapo: Leading The Charge For Tax Reform And Economic Recovery guide to help target audience make the right decision.

Key differences or Key takeways

| Feature | Senator Crapo's Tax Reform Plan |

|---|---|

| Corporate tax rate | 20% |

| Individual tax rates | 12%, 25%, and 35% |

| Standard deduction | $12,000 for individuals and $24,000 for married couples |

| Child tax credit | $2,000 per child |

| State and local tax deduction | Eliminated |

Transition to main article topics

FAQ

Senator Crapo, a leading advocate for tax reform and economic recovery, has compiled a list of frequently asked questions (FAQs) to address common concerns.

Question 1: Why is tax reform necessary?

The current tax code is overly complex, inefficient, and unfair. It stifles economic growth and discourages investment. Tax reform aims to simplify the code, lower tax rates, and provide incentives for businesses to create jobs and expand.

Question 2: How will tax reform benefit individuals?

The proposed reforms include tax rate reductions for all income brackets, a larger standard deduction, and an increased child tax credit. These changes will provide tax relief to working families, making it easier to save for the future and invest in their children.

Question 3: How will tax reform affect businesses?

The plan includes a reduction in the corporate tax rate, which will make it more competitive for American companies to operate domestically and internationally. Additionally, it provides incentives for businesses to invest in new equipment and hire more employees.

Question 4: Will tax reform increase the deficit?

The Congressional Budget Office has estimated that the proposed reforms will reduce the deficit in the long term. The economic growth generated by the reforms will offset the initial revenue loss from tax rate reductions.

Question 5: Is tax reform a partisan issue?

Tax reform is not a partisan issue. It is a matter of creating a fair and efficient tax code that promotes economic growth and benefits all Americans.

Question 6: What is the next step in the tax reform process?

The Senate Finance Committee is currently considering the tax reform plan. Once it is approved by the committee, it will go to the full Senate for a vote. If passed by the Senate, the plan will then go to a conference committee with the House of Representatives to reconcile the differences between the two versions.

Senator Crapo is committed to working towards a comprehensive tax reform package that will boost the economy and create jobs for all Americans.

Tips By Senator Mike Crapo: Leading The Charge For Tax Reform And Economic Recovery

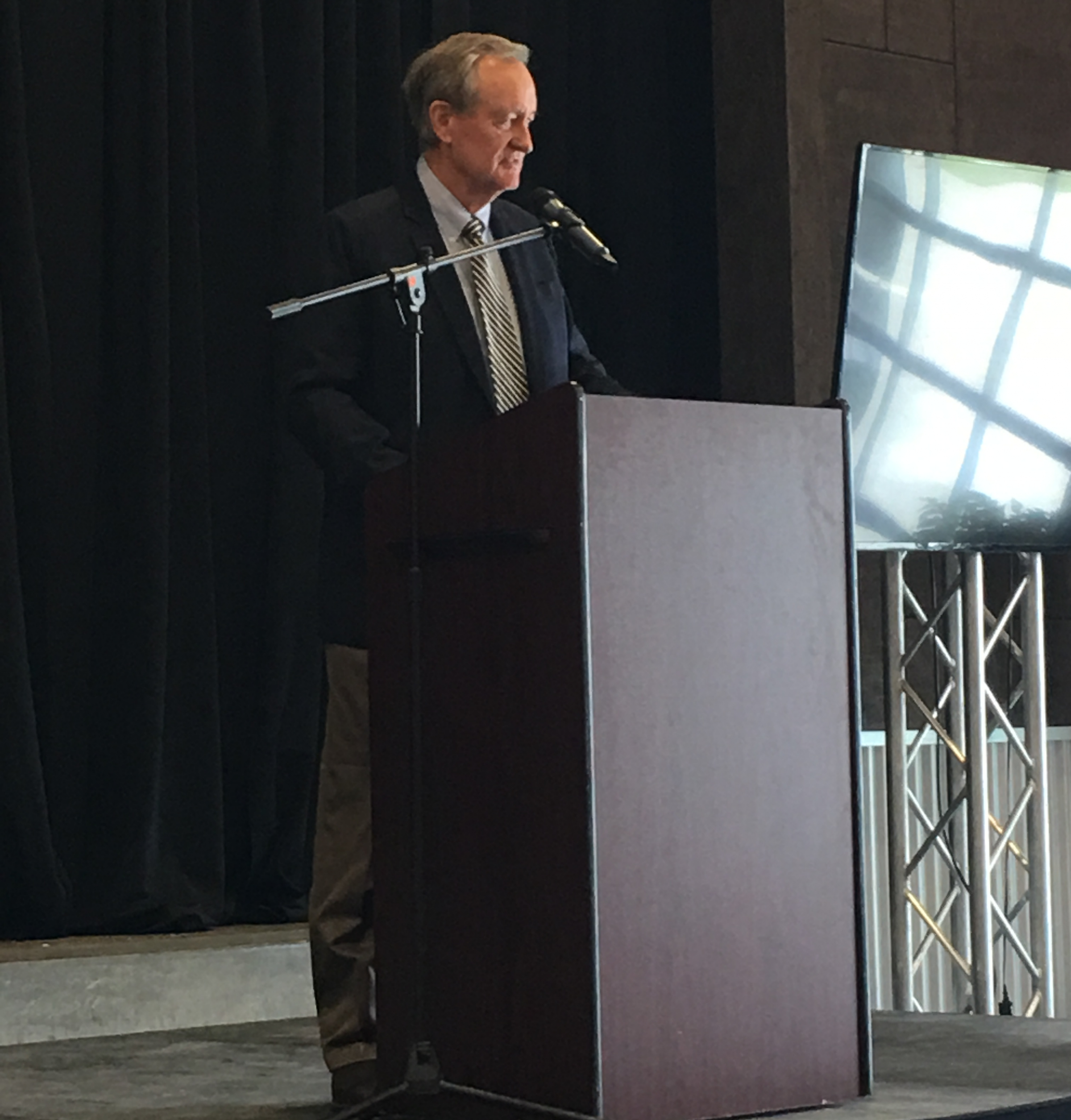

Kevin Miller Visits Senator Crapo - Source kidotalkradio.com

In this article, we will explore key takeaways and tips by Senator Crapo: Leading The Charge For Tax Reform And Economic Recovery. By implementing these strategies, businesses and individuals can navigate the complexities of tax reform and maximize its benefits.

Tip 1: Utilize the Tax Cuts and Jobs Act

This act provides significant tax savings for businesses and individuals. Businesses can take advantage of the reduced corporate tax rate, while individuals can benefit from increased deductions and credits.

Tip 2: Plan Ahead for Tax Season

Gather all necessary tax documents in advance to ensure timely and accurate tax filing. Utilize tax software or consult with a tax professional to optimize deductions and credits.

Tip 3: Invest in Tax-Advantaged Accounts

Consider contributing to 401(k)s and IRAs to reduce taxable income and potentially earn higher returns on retirement savings.

Tip 4: Explore Tax-Efficient Investments

Research investments such as municipal bonds and high-yield savings accounts that offer tax-free or tax-deferred earnings.

Tip 5: Stay Informed on Tax Law Changes

Regularly monitor updates to tax laws and regulations to stay abreast of potential changes that may impact tax liability.

To maximize the benefits of tax reform, consider these tips. By utilizing the Tax Cuts and Jobs Act, planning ahead, investing wisely, and staying informed, businesses and individuals can navigate the complexities of the new tax landscape and enhance their financial well-being.

Senator Crapo: Leading The Charge For Tax Reform And Economic Recovery

Tax reform and economic recovery have taken center stage under Senator Crapo's stewardship, with crucial aspects emerging as cornerstones of his leadership.

- Fiscal Policy:

Hauck joins charge to promote economic growth, eliminate burdensome - Source www.senatorrogerhauck.com - Economic Growth:

Senator Mike Crapo (@MikeCrapo) / Twitter - Source twitter.com - Business Incentives:

Senator Michael Crapo apologizes to family, Idaho constituents after - Source www.pennlive.com - Investment Expansion:

In Wake of Mass Shootings Senator Crapo Addresses IF City Club | KISU - Source www.kisu.org - Job Creation:

- Global Competitiveness:

Immigration reform taxes could help states with post-COVID economic - Source www.accountingtoday.com

Senator Crapo's legislative efforts have aimed to streamline the tax code, reduce regulatory burdens on businesses, and foster a conducive environment for investment and economic growth. Through these initiatives, he seeks to enhance America's global competitiveness, create employment opportunities, and ultimately revitalize the U.S. economy.

Senator Crapo: Leading The Charge For Tax Reform And Economic Recovery

Senator Crapo, a Republican from Idaho, has been a leading advocate for tax reform. He believes that the current tax code is too complex and burdensome, and that it stifles economic growth. Crapo has introduced several bills to simplify the tax code and reduce taxes for businesses and individuals. His efforts have been supported by many in the business community, who believe that tax reform is essential for job creation and economic growth.

Holy Crapo! Cannabis Banking Reform Makes Surprise Headway | Leafly - Source www.leafly.com

One of Crapo's most significant proposals is the Tax Cuts and Jobs Act of 2017. This bill would reduce the corporate tax rate from 35% to 20%, and the individual income tax rate from 39.6% to 35%. It would also eliminate many deductions and credits, and increase the standard deduction. The Tax Cuts and Jobs Act has been praised by many Republicans, who believe that it will boost the economy and create jobs. However, Democrats have criticized the bill, arguing that it will benefit the wealthy at the expense of the middle class.

The Tax Cuts and Jobs Act is still under consideration by Congress. It is unclear whether the bill will be passed, but it is clear that Crapo is a leading voice in the debate over tax reform. His efforts to simplify the tax code and reduce taxes have been supported by many in the business community, and he is likely to continue to play a major role in the tax reform debate.

Conclusion

Senator Crapo's efforts to reform the tax code are a significant part of his agenda for economic recovery. He believes that the current tax code is too complex and burdensome, and that it stifles economic growth. Crapo's proposals would simplify the tax code, reduce taxes for businesses and individuals, and eliminate many deductions and credits. These changes would make the tax code more efficient and fairer, and they would boost the economy and create jobs.

Crapo's tax reform proposals have been praised by many in the business community, but they have also been criticized by Democrats. The Tax Cuts and Jobs Act is still under consideration by Congress, and it is unclear whether the bill will be passed. However, Crapo is a leading voice in the debate over tax reform, and his efforts are likely to have a major impact on the future of the tax code.

Jennifer Siebel Newsom: Philanthropist And Filmmaker Advocate For Women's Empowerment, Top-Notch Industrial Storage Solutions For Maximizing Efficiency And Space, Power Book III: Raising Kanan Season 4: The Rise Of A Dynasty, Sweet Magnolias: A Compelling Journey Of Friendship, Love, And Resilience, Unlock The Potential: The Latest AI Advancements For Enhanced Efficiency And Innovation, Scott Kimball: Trailblazing Entrepreneur And Digital Marketing Visionary, School Closings | Vermont, New Hampshire & New York | WCAX.com, HGTV Stars Reach Landmark Lawsuit Settlement, Alysa Liu: A Rising Star In The Figure Skating World, Jeff Buckley: The Haunting Voice That Left An Indelible Mark On Music,