Secure Your Financial Stability: A Comprehensive Guide To Social Security Stimulus Checks In 2025

How to Secure Your Financial Stability in 2025: A Comprehensive Guide to Social Security Stimulus Checks?

Editor's Note: As we approach 2025, it's crucial to stay informed about the potential Social Security stimulus checks that could significantly impact your financial stability.

After analyzing and gathering extensive information, we have compiled this comprehensive guide to empower you with the knowledge you need to make informed decisions and secure your financial well-being in 2025.

Key Differences and Takeaways:

| Social Security Stimulus Checks in 2025 | Traditional Social Security Benefits | |

|---|---|---|

| Purpose | Provide economic relief to citizens | Regular monthly payments for retirees, disabled individuals, and survivors |

| Eligibility | May be based on income and other criteria | Based on work history and contributions |

| Timeline | Subject to legislation and approval | Ongoing payments throughout eligibility |

Main Article Topics:

FAQ

This comprehensive guide provides expert insights into Social Security stimulus checks in 2025. To enhance your understanding, this FAQ section addresses frequently asked questions, ensuring clarity and accuracy.

How Much Is Social Security Disability Going Up In 2025 - May R. Lovins - Source mayrlovins.pages.dev

Question 1: Are Social Security stimulus checks guaranteed in 2025?

The availability of Social Security stimulus checks in 2025 depends on economic conditions and legislative decisions. While there is no definitive guarantee, the government may consider issuing stimulus checks if economic conditions warrant additional support for citizens.

Question 2: What factors influence the eligibility for stimulus checks?

Eligibility for stimulus checks typically considers factors such as income, tax filing status, and residency. The specific criteria may vary depending on the legislation and regulations in place at the time.

Question 3: How are stimulus check amounts determined?

The amount of stimulus checks is generally determined by the government based on economic conditions and the desired level of support for citizens. In previous stimulus programs, the amounts have varied depending on individual circumstances and household income.

Question 4: What is the timeline for receiving stimulus checks?

The timeline for receiving stimulus checks can vary depending on the method of distribution chosen by the government. In past programs, checks were issued via direct deposit or mailed to recipients.

Question 5: How can I stay informed about updates regarding stimulus checks?

To stay up-to-date on the latest news and announcements regarding Social Security stimulus checks, it is recommended to regularly check reliable sources such as government websites, reputable news outlets, and financial institutions.

Question 6: Where can I find additional resources and support related to stimulus checks?

For further information and support, individuals may refer to official government websites, contact their local Social Security offices, or consult with financial advisors for personalized guidance.

This FAQ section provides a concise overview of common questions surrounding Social Security stimulus checks. Stay informed and refer to reliable sources for the most accurate and up-to-date information.

To delve deeper into maximizing your financial stability, explore the next section of our comprehensive guide.

Tips

This Secure Your Financial Stability: A Comprehensive Guide To Social Security Stimulus Checks In 2025 offers valuable insights into maximizing the benefits of Social Security stimulus checks. To ensure financial stability, consider these expert tips:

Tip 1: Understand Eligibility Criteria

Determine if you qualify for stimulus checks by meeting specific income and residency requirements. Research eligibility guidelines thoroughly to avoid missing out on potential benefits.

Tip 2: Claim Your Funds Promptly

Upon eligibility confirmation, act promptly to claim your stimulus funds. Utilize available methods such as direct deposit, check, or prepaid debit card to receive payments efficiently.

Tip 3: Budget Wisely

Allocate stimulus funds strategically to address immediate financial needs or invest in long-term financial goals. Prioritize essential expenses, debt reduction, and emergency savings to strengthen financial stability.

Tip 4: Explore Additional Assistance Programs

Investigate other government or non-profit assistance programs that provide financial support or resources. Explore options such as food stamps, housing assistance, or job training to supplement your income and improve financial well-being.

Tip 5: Seek Professional Guidance

If financial challenges persist, consider seeking professional guidance from a financial advisor or credit counselor. They can assess your financial situation, provide personalized advice, and develop a plan to achieve financial stability.

Remember, these tips empower individuals to navigate the Social Security stimulus check program effectively. By following these guidelines, individuals can secure financial stability and navigate economic challenges with confidence.

Secure Your Financial Stability: A Comprehensive Guide To Social Security Stimulus Checks In 2025

In 2025, Social Security Stimulus Checks emerged as a critical safety net for individuals and businesses navigating unprecedented economic challenges. Understanding the essential aspects of these checks is crucial for leveraging their potential and securing financial stability.

These aspects provide a comprehensive framework for utilizing Social Security Stimulus Checks as a tool for financial stability. Understanding eligibility requirements ensures access to benefits, while considering tax implications minimizes potential tax liabilities. Economic impact underscores the significant role these checks play in bolstering economic recovery. Protection against fraud ensures funds are used for intended purposes, and exploring additional support options empowers individuals with holistic financial management strategies.

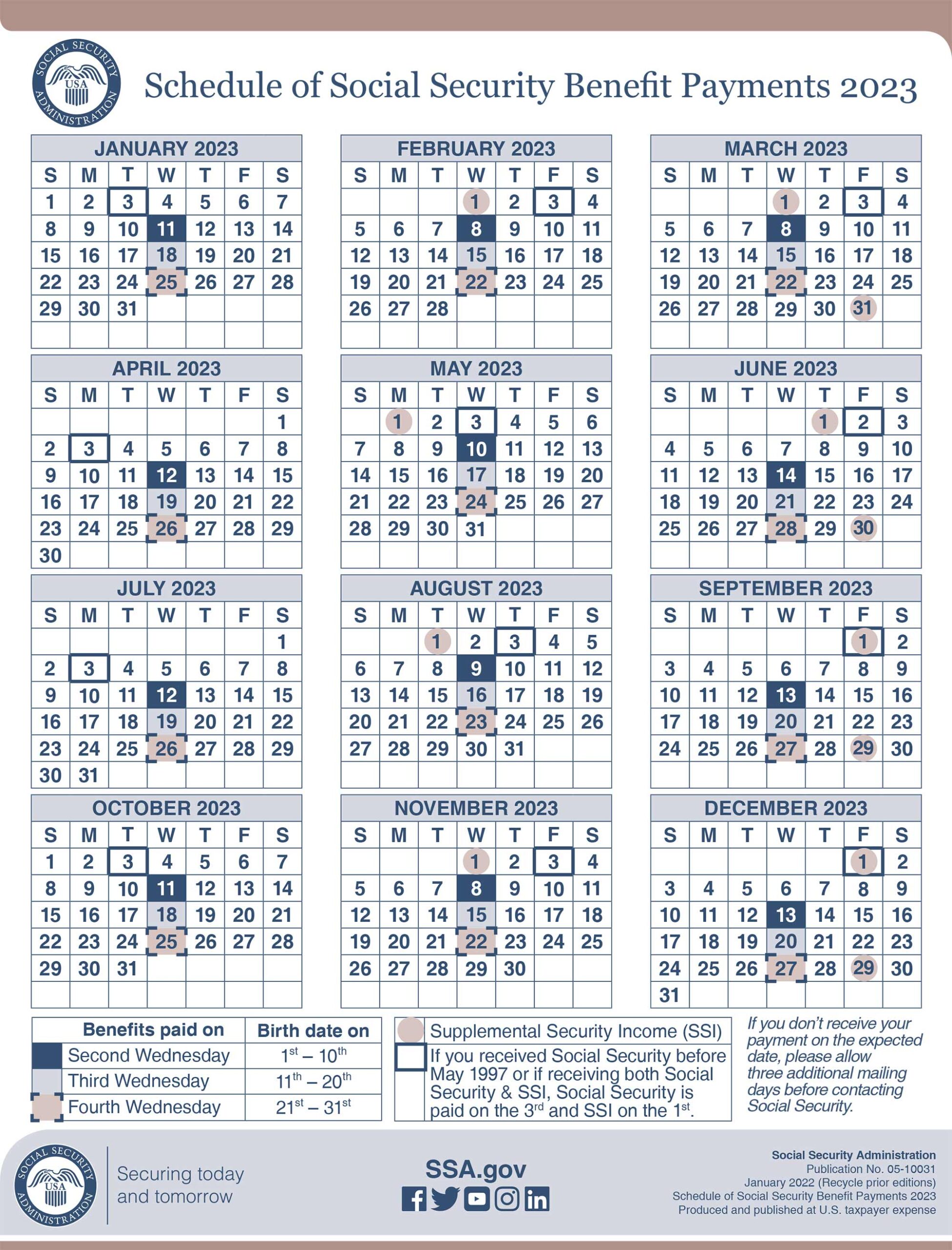

2023 Social Security Benefits Payment Schedule - TheAdviserMagazine.com - Source theadvisermagazine.com

Secure Your Financial Stability: A Comprehensive Guide To Social Security Stimulus Checks In 2025

The Social Security Stimulus Checks of 2025 are a critical component of the government's broader plan to secure financial stability for citizens. This guide provides a comprehensive overview of the Stimulus Checks, including eligibility requirements, payment procedures, and potential impacts.

Social Security / Stimulus Checks for New Social Security Claimants - Source susiee-images.blogspot.com

The Stimulus Checks are designed to provide financial relief to individuals and families struggling to cope with the economic fallout of the pandemic. By understanding the eligibility criteria and payment procedures, individuals can ensure they receive the support they are entitled to.

The Stimulus Checks are essential for mitigating the financial burden faced by many Americans. By providing direct financial assistance, the government aims to stimulate the economy and promote financial stability.

Table: Key Features of Social Security Stimulus Checks in 2025

| Feature | Details |

|---|---|

| Eligibility | Based on income and citizenship status |

| Payment Amount | Varies depending on income and family size |

| Payment Method | Direct deposit, check, or debit card |

| Economic Impact | Increased consumer spending, job creation |

Conclusion

In conclusion, the Social Security Stimulus Checks of 2025 play a vital role in securing financial stability for citizens. The comprehensive guide provided in this article empowers individuals to understand their eligibility, receive payment, and leverage the economic benefits of the Stimulus Checks.

The government's commitment to financial stability underscores the importance of these Stimulus Checks, ensuring that individuals and families can weather economic challenges and contribute to the nation's recovery.

Jordan Peele: The Master Of Modern Horror, VTI: Vanguard Total Stock Market ETF - A Comprehensive Guide To Invest In The Entire U.S. Stock Market, Super Bowl LVIII: Epic Clash Between Cincinnati Bengals And Los Angeles Rams, Rick Reigenborn: Sportscaster, Commentator, And Radio Host, Experience The Ultimate South Florida Fair: A Carnival Of Excitement, Delectable Delights, And Unforgettable Memories, Meet The Unstoppable Force Behind Chicago PD: Uncovering The Cast's Journey, John Morton: Archbishop Of Canterbury And Lord Chancellor Of England, Unveiling The Excellence Of UW Madison: A Beacon Of Academic Excellence And Innovation, Taylor Rogers: MLB Relief Pitcher For The Chicago Cubs, Minnesota Dominates Michigan In Showcase Battle,