Mortgage Rates Today: Real-Time Updates And Market Insights

Mortgage Rates Today: Real-Time Updates And Market Insights!

Editor's Notes: Mortgage Rates Today: Real-Time Updates And Market Insights have published today, 4 March 2023. This topic is important to understand for everyone who is interested in real estate and mortgages.

In this guide, we will dive into the world of mortgage rates, providing you with real-time updates and valuable market insights. By the end of this piece, you will have a comprehensive understanding of the mortgage market, enabling you to make informed decisions when it comes to securing financing for your dream home.

Key Differences

| Fixed-Rate Mortgage | Variable-Rate Mortgage |

|---|---|

| Interest rate remains the same throughout the loan term | Interest rate can fluctuate with market conditions |

| Provides stability in monthly payments | Can result in lower payments initially, but could increase in the future |

| Suitable for borrowers who prefer predictability | Can be beneficial for borrowers who expect interest rates to decrease |

Main Article Topics

- Current Mortgage Rate Trends

- Factors Influencing Mortgage Rates

- Fixed-Rate vs. Variable-Rate Mortgages

- How to Get the Best Mortgage Rate

- Mortgage Rate Forecasts

FAQ

This comprehensive FAQ section provides clear and informative answers to common questions regarding mortgage rates, empowering individuals to make informed decisions about their home financing.

Question 1: What factors influence mortgage rates?

Mortgage rates fluctuate based on economic conditions, including inflation, interest rate benchmarks set by central banks, and the supply and demand for mortgage loans.

Question 2: How can I secure the best mortgage rate?

To obtain the most favorable mortgage rate, it's crucial to maintain a strong credit score, minimize debt-to-income ratio, save for a substantial down payment, shop around among multiple lenders, and consider locking in a rate when it aligns with financial goals.

Question 3: What are the different types of mortgage loans?

Common mortgage loan types include fixed-rate mortgages, adjustable-rate mortgages (ARMs), Federal Housing Administration (FHA) loans, and Veterans Affairs (VA) loans, each tailored to specific circumstances and financial situations.

Question 4: How do mortgage interest rates affect monthly payments?

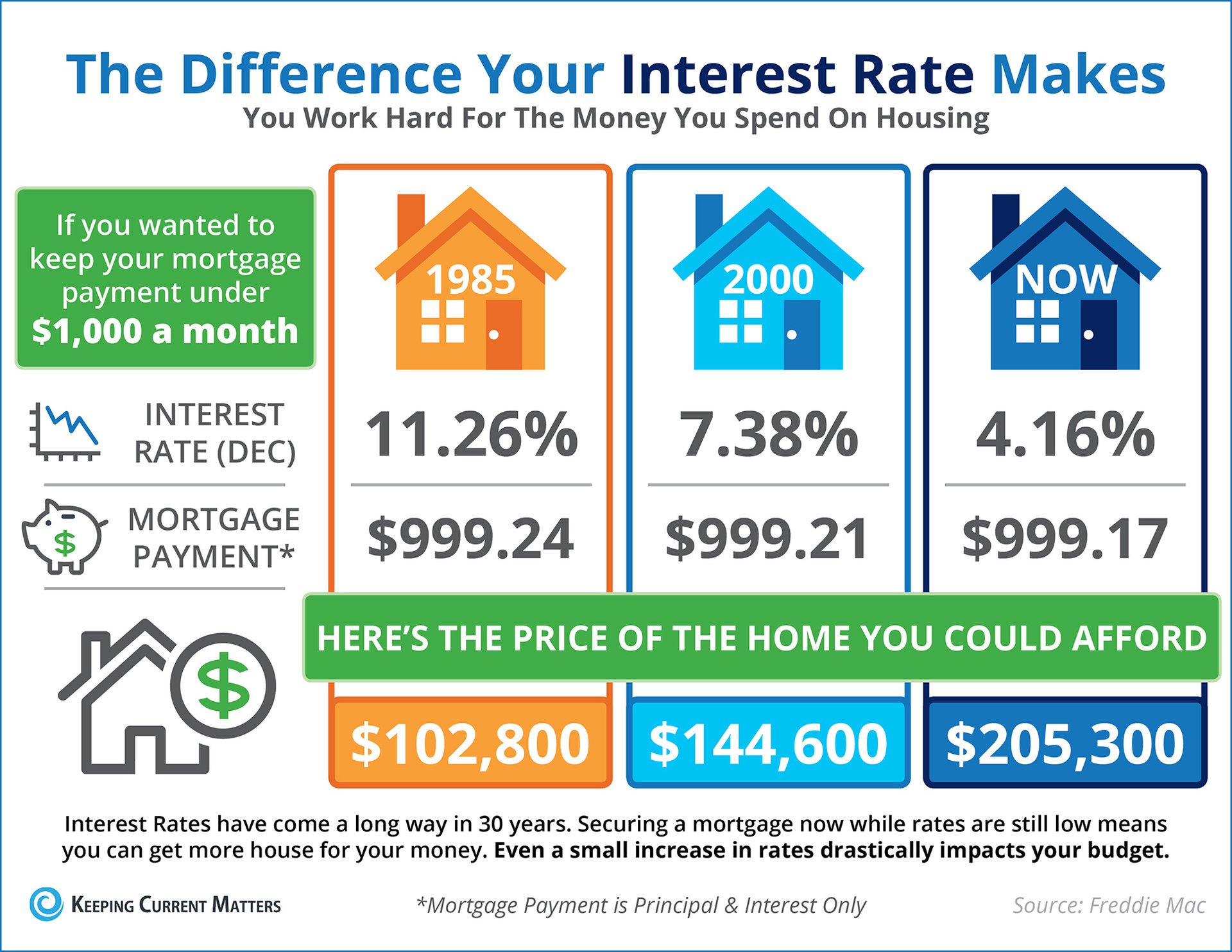

Mortgage interest rates directly impact monthly mortgage payments. Higher interest rates result in increased monthly payments, while lower rates lead to decreased payments, significantly affecting long-term affordability.

Question 5: What should I consider when refinancing a mortgage?

When considering mortgage refinancing, it's essential to assess closing costs, potential savings, the break-even point, and the impact on long-term financial goals, ensuring that refinancing aligns with individual circumstances.

Question 6: How can I stay informed about mortgage rate trends?

To remain up-to-date on mortgage rate developments, it's advisable to consult reputable sources such as government agencies, financial institutions, and mortgage rate tracking websites, providing valuable insights to guide decision-making.

By utilizing the information provided in this FAQ section, individuals can navigate the complexities of mortgage rates and make informed decisions that align with their financial aspirations.

Mortgage Interest Rates Today 2024 Nj - Denyse Gerianne - Source lydieqsimone.pages.dev

Tips

With the ever-changing landscape of the mortgage market, it's important to stay informed about the latest Mortgage Rates Today: Real-Time Updates And Market Insights and trends. Here are some tips to help you navigate the complexities of the market and make informed decisions about your mortgage.

Tip 1: Start with your credit.

Your credit score is one of the most important factors that will affect your mortgage rate. A higher credit score will qualify you for a lower interest rate, saving you money on your monthly payments. You can get a free copy of your credit report from each of the three major credit bureaus once per year at annualcreditreport.com.

Tip 2: Get pre-approved.

Getting pre-approved for a mortgage will give you a clear idea of how much you can afford to borrow and will make you a more competitive buyer in the current market. Pre-approval also locks in your interest rate for a period of time, protecting you from rising rates.

Tip 3: Shop around.

Don't just go with the first lender you talk to. Take the time to compare rates and fees from multiple lenders to make sure you're getting the best deal possible.

Tip 4: Understand the different types of mortgages.

There are many different types of mortgages available, each with its own unique set of features and benefits. Make sure you understand the different options before you apply for a loan so that you can choose the one that's right for you.

Tip 5: Don't forget about closing costs.

Closing costs are the fees that you'll have to pay when you get a mortgage. These costs can vary depending on the lender and the type of loan you get, so it's important to factor them into your budget.

By following these tips, you can increase your chances of getting the best possible mortgage rate and saving money on your monthly payments.

Mortgage Rates Today: Real-Time Updates And Market Insights

Real-time updates and market insights on mortgage rates are crucial for prospective homeowners and investors alike. To gain a comprehensive understanding of this dynamic market, it's essential to consider key aspects such as market trends, economic indicators, and geopolitical influences.

- Current Rates: Stay informed about the prevailing mortgage rates across different loan types and terms.

- Historical Trends: Analyze historical data to identify patterns and forecast future rate movements.

- Economic Factors: Understand the impact of inflation, unemployment, and GDP growth on mortgage rates.

- Government Policies: Monitor changes in monetary policy, fiscal measures, and regulations that affect mortgage markets.

- Geopolitical Events: Be aware of global events and uncertainties that can influence interest rates and mortgage availability.

- Lender Comparison: Compare rates and terms offered by multiple lenders to secure the best deal for your financial situation.

By considering these key aspects, you can navigate the ever-changing mortgage landscape with confidence. Real-time updates provide timely information on market fluctuations, while insights help you interpret the data and make informed decisions. Additionally, understanding the underlying economic forces and geopolitical influences empowers you to anticipate market trends and adjust your financial strategies accordingly.

Mortgage Rates 2024 Today Usa - Esta Olenka - Source alaineymarybelle.pages.dev

Mortgage Rates Today: Real-Time Updates And Market Insights

Understanding the factors that influence mortgage rates is crucial for individuals and investors alike. Economic conditions, Federal Reserve policies, and global financial markets all play significant roles in determining these rates. Real-time updates and market insights provide valuable information for informed decision-making.

Mortgage Rates as of today 9/8/14 - Ana Thigpen, Broker/Realtor - Source anathigpen.com

Mortgage rates are closely tied to the overall health of the economy. When the economy is strong, inflation is typically low and interest rates remain steady or even decline. Conversely, when the economy slows down, inflation can rise, leading to higher interest rates. The Federal Reserve influences mortgage rates through its monetary policy decisions, such as adjusting the federal funds rate. By raising or lowering this rate, the Fed can impact the cost of borrowing money, including mortgages.

Global financial markets also affect mortgage rates. Investors worldwide seek out safe havens for their investments during times of uncertainty, and the U.S. mortgage market often benefits from this demand. Increased investment in mortgage-backed securities can lead to lower mortgage rates.

By understanding the connections between economic conditions, Federal Reserve policies, and global financial markets, individuals and investors can make informed decisions about their mortgage financing. Real-time updates and market insights provide valuable tools for navigating the complexities of mortgage rates.

Uzbekistan And Jordan: Uncovering The Treasures Of The Silk Road And The Red Sea, Jennifer Siebel Newsom: Philanthropist And Filmmaker Advocate For Women's Empowerment, Thad Lewis: Former NFL Quarterback And Sports Analyst, Andy Reid's Super Bowl Journey: From Heartbreak To Triumph, The Rise Of The Hamlin Bills: A Resurgent Force In The NFL, Sagittarius Daily Horoscope: Embrace New Opportunities And Seek Adventure, Andy Reid: The Super Bowl-Winning Coach's Legacy And Coaching Philosophy, The Crowned Champions Of Super Bowl LVI: Unveiling The Triumphant Team, In Memory: Kobe Bryant, Basketball Legend, Dies In Tragic Helicopter Crash, January 2025 New Moon: Your Guide To The Dark Moon,