Inflationary Trends And Economic Outlook In 2025: Understanding The Financial Landscape

The talk of the day is Inflationary Trends and Economic Outlook in 2025. With global financial uncertainties and rapid inflation, grasping the upcoming economic outlook has become pivotal. Today is the day you will get a full view of the Inflationary Trends and Economic Outlook in 2025 after reading this guide.

Editor's Notes: Inflationary Trends and Economic Outlook in 2025: Understanding The Financial Landscape guide has published on date.

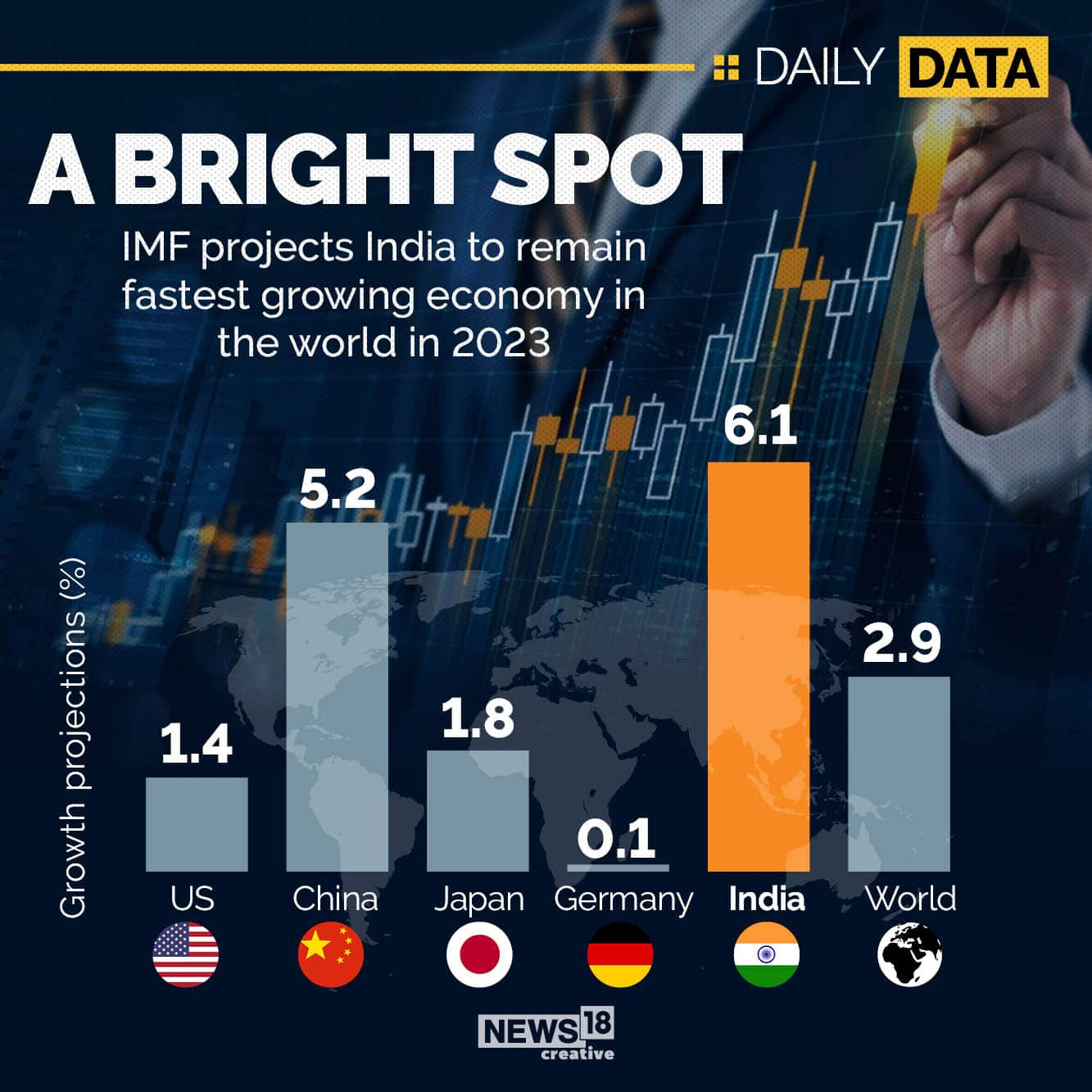

Actualización de Perspectivas de la economía mundial de julio de 2023 - Source www.imf.org

We have meticulously put together this Inflationary Trends and Economic Outlook in 2025: Understanding The Financial Landscape guide to help our target audiences make the right decision after doing some analysis and gathering information.

Our efforts of doing a comprehensive Inflationary Trends and Economic Outlook in 2025: Understanding The Financial Landscape guide will help you in the following ways.

| Key Differences | To Know | Key Takeaways |

|---|---|---|

| Will inflation continue to rise? | Yes, inflation is expected to be slightly elevated in 2025, but it should moderate from the high levels seen in 2022 and 2023. | The Federal Reserve is expected to continue raising interest rates in 2025 to combat inflation. |

| What will be the economic outlook in 2025? | The economic outlook for 2025 is positive, but there are some risks to the forecast. The global economy is expected to grow at a moderate pace, but there are risks from geopolitical tensions, trade disputes, and the COVID-19 pandemic. | The United States economy is expected to grow at a slightly faster pace than the global economy in 2025. |

| What are some of the biggest challenges facing the economy in 2025? | Some of the biggest challenges facing the economy in 2025 include inflation, the Federal Reserve's interest rate hikes, and the war in Ukraine. | The Federal Reserve will need to carefully balance its goals of controlling inflation and promoting economic growth. |

We will continue to track the latest developments in the economy and update our forecast accordingly.

FAQ: Inflationary Trends and Economic Outlook in 2025

The following frequently asked questions and answers serve to provide clarity on the complex economic landscape expected in 2025.

Question 1: Will inflation continue to rise in 2025?

Answer: Inflationary pressures are expected to persist in 2025, though at a moderated pace compared to 2023. While supply chain disruptions ease and geopolitical tensions subside, underlying economic factors such as wage growth and energy prices will continue to exert upward pressure on prices.

Question 2: What are the potential implications of rising inflation?

Answer: Prolonged inflation can erode the purchasing power of consumers, leading to a decline in real incomes. It also impacts business profitability and investment decisions, potentially slowing economic growth.

Question 3: How will the Federal Reserve respond to inflation?

Answer: The Federal Reserve is committed to maintaining price stability and will likely continue its monetary tightening policy to curb inflation. This could involve further interest rate hikes and quantitative tightening measures.

Question 4: What impact will inflation have on the stock market?

Answer: Inflation tends to have mixed effects on the stock market. Some sectors, such as real estate and commodities, may benefit from rising prices, while others, such as technology and consumer discretionary, may face challenges.

Question 5: What should investors do to prepare for inflation?

Answer: Investors can consider diversifying their portfolios into inflation-hedged assets, such as Treasury Inflation-Protected Securities (TIPS) and real estate. Allocating a portion of investments to commodities and emerging markets can also provide some protection.

Question 6: What are the economic growth prospects for 2025?

Answer: Economic growth in 2025 is expected to moderate from the strong post-pandemic recovery. While inflation and geopolitical risks remain, underlying economic fundamentals such as consumer spending and technological advancements will support continued growth.

Understanding the inflationary trends and economic outlook for 2025 is crucial. By staying informed and making informed financial decisions, individuals and businesses can navigate the challenges and prepare for the opportunities that this dynamic economic landscape presents.

Next: Explore Strategies for Navigating Inflation in 2025

Tips

Navigate the evolving financial landscape in 2025 by incorporating these strategic tips into your planning.

Tip 1: Monitor Inflationary Trends

Stay informed about inflation rates and their impact on the economy. Consider Inflationary Trends And Economic Outlook In 2025: Understanding The Financial Landscape to anticipate potential shifts.

Tip 2: Diversify Investments

Spread investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk and enhance returns.

Tip 3: Consider Alternative Investments

Explore alternative investments like private equity or hedge funds to potentially generate higher returns, albeit with higher risk.

Tip 4: Enhance Savings

Increase savings rates to accumulate more funds for future financial needs, including inflation-protected investments.

Tip 5: Plan for Retirement

Start or adjust retirement savings plans early on to ensure financial security in the future, considering inflation's potential impact on retirement expenses.

By implementing these tips, individuals can navigate the financial landscape of 2025 and position themselves for financial stability and growth.

...

Inflationary Trends And Economic Outlook In 2025: Understanding The Financial Landscape

The economic landscape in 2025 is likely to be shaped by several key inflationary trends that will impact businesses, governments, and individuals alike. These trends include:

World Economic Ranking 2024 India Rank - Erna Odette - Source rosevbernelle.pages.dev

- Rising Energy Costs: Escalating global energy consumption and supply-demand imbalances are driving up the prices of fossil fuels, leading to increased transportation and utility costs.

- Supply Chain Disruptions: Ongoing supply chain challenges, exacerbated by factors such as the COVID-19 pandemic, are causing shortages and higher input costs for businesses.

- Increased Demand: Strong consumer demand coupled with low inventory levels is pushing prices higher, particularly for essential goods and services.

- Labor Market Dynamics: Tight labor markets and wage pressures are contributing to higher production costs, which are passed on to consumers.

- Monetary Policy: Central banks' efforts to mitigate inflation through interest rate hikes can impact economic growth and borrowing costs.

- Fiscal Policy: Government spending and tax policies can either stimulate or curb inflation, depending on their design and implementation.

Understanding these inflationary trends is crucial for effective decision-making in the financial landscape. Businesses need to adjust supply chains and pricing strategies, while governments must balance growth and inflation management. Individuals should prepare for rising living expenses and consider inflation adjustments in their financial plans.

Inflation Rate Australia 2025 Graph 2025 - Zena Angelia - Source georgeasemarietta.pages.dev

Inflationary Trends And Economic Outlook In 2025: Understanding The Financial Landscape

The interplay between Inflationary Trends and the Economic Outlook in 2025 is of paramount importance in determining the financial landscape. Inflation, a sustained increase in the general price level of goods and services over time, can have profound effects on economic growth, purchasing power, and financial stability. Understanding the interplay between these factors provides crucial insights for businesses, investors, and policymakers.

World Economic Outlook Update, July 2023: Near-Term Resilience - Source www.imf.org

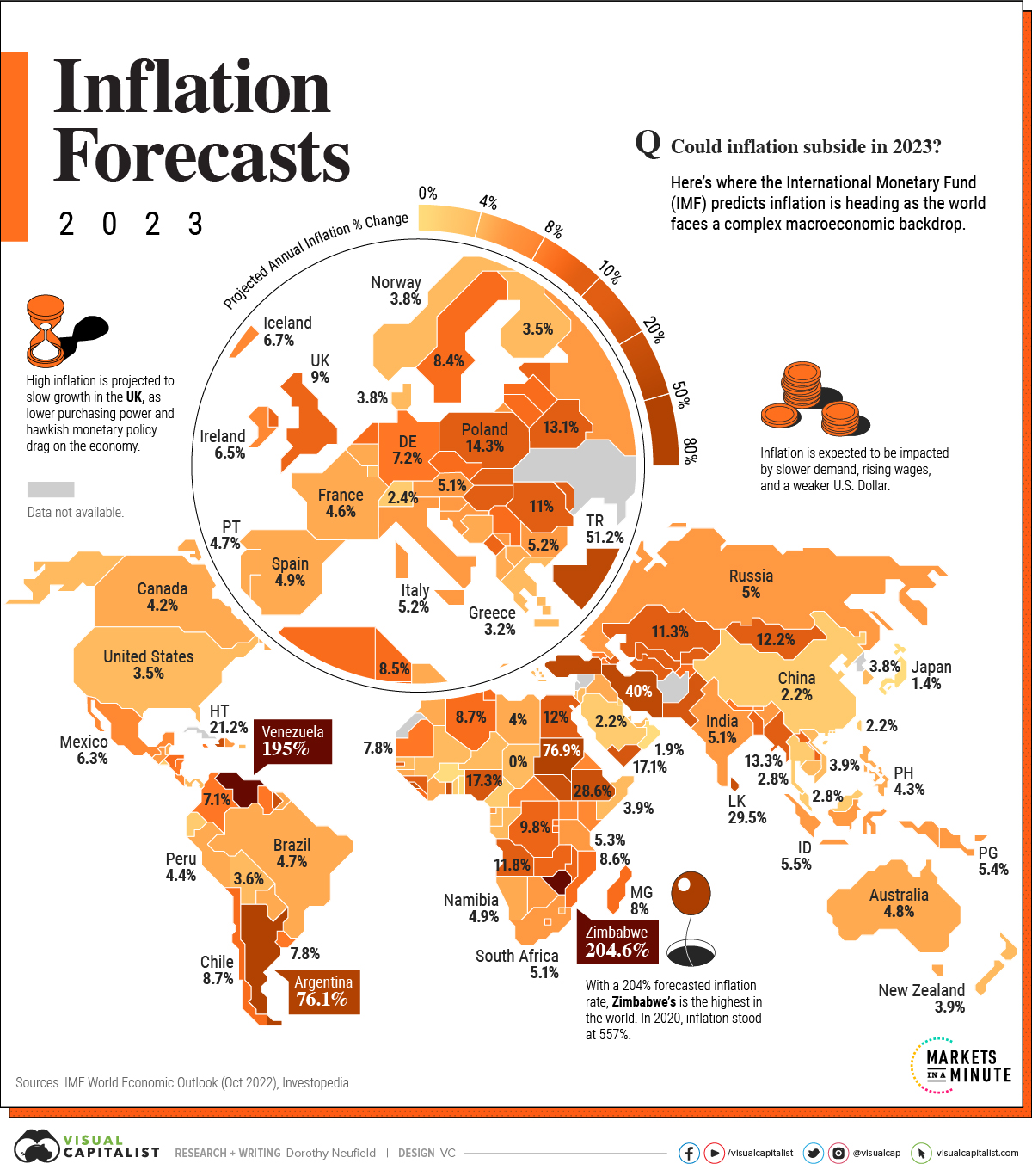

Inflationary trends are influenced by a complex web of factors, including supply and demand dynamics, monetary policy, fiscal policy, and geopolitical events. In recent years, the global economy has experienced a surge in inflation, driven by factors such as supply chain disruptions, labor shortages, and expansionary monetary policies. This has raised concerns among economists and policymakers about the potential impact on long-term economic growth and stability.

The economic outlook for 2025 is uncertain, depending heavily on the path of inflation. If inflationary pressures persist, businesses may face higher input costs, leading to lower profit margins and reduced investment. Consumers may see their purchasing power erode, leading to a decline in demand and economic growth. Central banks may have to tighten monetary policy by raising interest rates, which can further slow economic activity. However, if inflation can be brought under control and maintained at a moderate level, it could support economic growth by reducing uncertainty and stimulating investment.

| Year | Inflation Rate (%) | Impact |

|---|---|---|

| 2021 | 7.5 | Sharp increase in consumer prices, reduced purchasing power |

| 2008 | 3.8 | Moderate inflation, supported economic growth |

| 1979 | 13.3 | High inflation, eroded savings, slowed economic growth |

Understanding the connection between inflationary trends and the economic outlook is critical for navigating the financial landscape in 2025. Businesses and investors should closely monitor inflation data and economic indicators to make informed decisions about investments, pricing strategies, and risk management. Policymakers have a crucial role to play in managing inflation and promoting economic growth through appropriate monetary and fiscal policies.

Play Xổ Số Khánh Hòa For Exciting Lottery Draws And Prizes, Lịch Chiếu Phim Mới Nhất: Cập Nhật Phút Chót Về Giờ Chiếu Và Rạp Chiếu, Robert Reich: The Inequality Crisis And The Path To A Just Economy, Discover The Home Of The Demon Deacons: Exploring Wake Forest University, Jalen Hurts Sets Rushing Record, Propeling Eagles To Victory, Friday Night Lights: Gridiron Dreams, Small-Town Spirit, Vice President's Residence: A Historical Gem And Modern Symbol Of American Democracy, Celebrating Music's Biggest Night: 65th GRAMMY Awards Highlight Music's Power To Unite And Inspire, Heartbreaking Tragedy: Remembering Tristyn Bailey, The Girl Who Inspired A Community, Understanding The IRS Digital Income Tax Rule: A Comprehensive Guide For Today's Taxpayers,