Economy News: Inflation Falls, Interest Rate Hike Likely On Horizon

Economy News: Inflation Falls, Interest Rate Hike Likely On Horizon

Editor's Notes: Economy News: Inflation Falls, Interest Rate Hike Likely On Horizon have published today date: Why does this topic matter?

Our team has done the analysis and we've dug into the data, and we have put together this Economy News: Inflation Falls, Interest Rate Hike Likely On Horizon guide to help you make the right decision.

Global Financial System Tested by Higher Inflation and Interest Rates - Source www.imf.org

FAQ

Economy News: Inflation Falls, Interest Rate Hike Likely On Horizon

Fed rate hike - Sublimation Online Diary Sales Of Photos - Source experimentieren-forschen.blogspot.com

Question 1: What are the reasons behind the recent inflation drop?

Answer: The decline in inflation is attributed to several factors, including a decrease in global commodity prices, easing supply chain disruptions, and a slowdown in consumer spending.

Question 2: How is the interest rate hike expected to impact the economy?

Answer: Raising interest rates aims to curb inflation by making borrowing more expensive, thus reducing consumer spending and business investments. However, it may also slow down economic growth.

Question 3: What are the potential risks associated with an interest rate hike?

Answer: Increasing interest rates too rapidly could lead to a sharp economic downturn, reduce investment, and increase unemployment.

Question 4: What is the outlook for inflation in the coming months?

Answer: While inflation has shown a recent decrease, economists predict it to remain elevated for some time before gradually declining toward central bank targets.

Question 5: How should individuals prepare for a potential interest rate hike?

Answer: Individuals should consider adjusting their budgets, reducing debt, and exploring higher-yield savings accounts to mitigate the potential negative impacts.

Question 6: What role does the government play in managing inflation and interest rates?

Answer: Central banks and governments use various monetary and fiscal policies to influence inflation and interest rates, aiming to maintain economic stability and promote growth.

Summary: The recent decline in inflation likely marks a gradual easing of price pressures. However, the expected interest rate hike aims to further curb inflation while potentially affecting economic growth. Individuals should prepare for its impact by adjusting their financial strategies.

Next: Exploring Alternative Investments in a Changing Economic Landscape

Tips

US Federal Reserve Hikes Interest Rates to Curb Inflation - GlobalData - Source www.globaldata.com

The recent fall in inflation may be a sign of relief for consumers, but it could also signal an upcoming interest rate hike by the Federal Reserve. Here are some tips to help you prepare for this potential change in the financial landscape:

Tip 1: Review your budget and cut back on unnecessary expenses.

With interest rates rising, it becomes more expensive to borrow money. Therefore, it's wise to reduce your debt burden and increase your savings rate.

Tip 2: Consider refinancing your debt.

If you have a variable-rate loan, such as a credit card or home equity line of credit, you may be able to lower your interest payments by refinancing to a fixed-rate loan.

Tip 3: Increase your savings.

Rising interest rates can make it more difficult to earn returns on your savings, so it's important to start saving more now. Consider setting up automatic transfers from your checking to your savings account on a regular basis.

Tip 4: Shop around for better rates on your financial products.

When interest rates rise, banks and other financial institutions often pass those costs on to consumers. To avoid paying higher fees, compare rates from different providers before opening a new account or renewing an existing one.

Tip 5: Talk to a financial advisor.

If you're concerned about the impact of rising interest rates on your finances, consider speaking to a financial advisor. They can help you develop a plan to meet your specific financial goals.

Economy News: Inflation Falls, Interest Rate Hike Likely On Horizon

Summary of key takeaways or benefits:

Preparing for higher interest rates can help you manage your finances and minimize the impact on your financial goals. By following these tips, you can protect your savings, reduce your debt, and make informed financial decisions.

Transition to the article's conclusion:

While the future of interest rates remains uncertain, it's important to be prepared for potential changes. By following these tips, you can take control of your finances and weather any economic storm.

Economy News: Inflation Falls, Interest Rate Hike Likely On Horizon

The recent fall in inflation has raised speculation about an impending interest rate hike. This news has significant implications for both consumers and investors, and it is essential to understand the key aspects of this development.

- Inflation Rate: Has declined in recent months, easing inflationary pressures.

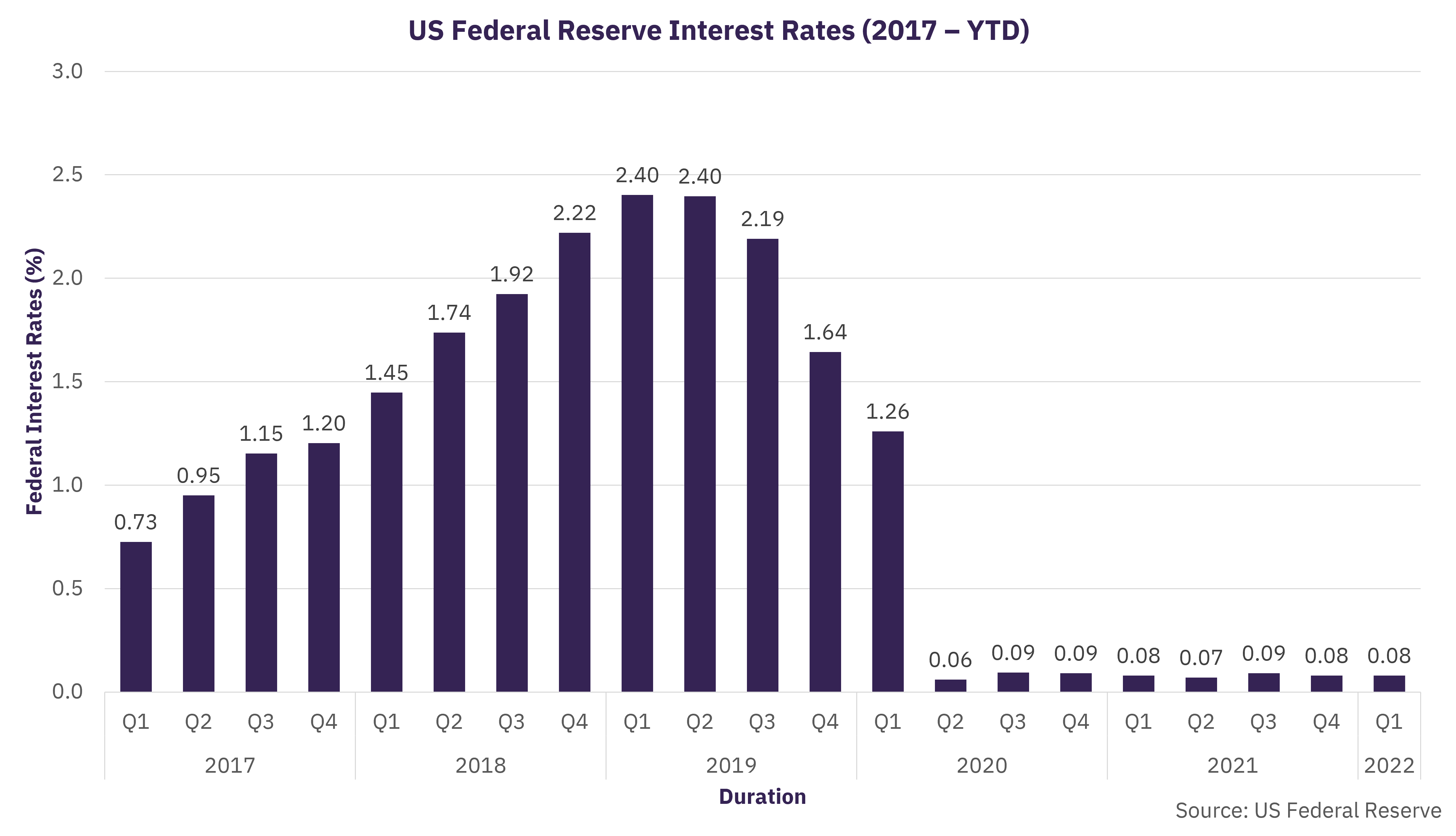

- Interest Rate: Central banks consider raising interest rates to curb inflation.

- Consumer Spending: Higher interest rates make borrowing more expensive, potentially reducing consumer spending.

- Corporate Borrowing: Increased interest rates impact corporate borrowing costs, potentially affecting investment and growth.

- Bond Market: Interest rate hikes affect bond prices, as investors adjust to changing interest rates.

- Economic Growth: Navigating the delicate balance between curbing inflation while maintaining economic growth is crucial.

The interplay between inflation, interest rates, and economic growth is complex. Central banks must carefully consider the potential impact of interest rate hikes on the broader economy. By understanding these key aspects, individuals can make informed decisions regarding their financial planning and investment strategies.

The Federal Reserve signals more to come even as it slows rate - Source www.nytimes.com

Economy News: Inflation Falls, Interest Rate Hike Likely On Horizon

The recent dip in inflation has sparked speculation about the possibility of an upcoming interest rate hike. Inflation, a measure of the general price level of goods and services, has been steadily decreasing in recent months due to a combination of factors, including the easing of supply chain disruptions and the Federal Reserve's aggressive monetary policy tightening. This has raised expectations that the Fed may soon consider slowing the pace of its rate hikes or even pausing them altogether. However, some economists believe that the Fed is likely to remain cautious and maintain a hawkish stance as it continues to monitor inflation data closely.

Chart: The Most Aggressive Tightening Cycle in Decades | Statista - Source www.statista.com

The decision on whether or not to raise interest rates is a delicate balancing act for the Fed. On the one hand, the Fed is committed to bringing inflation back to its target of 2%. On the other hand, raising rates too quickly could stifle economic growth and lead to a recession. The Fed will need to carefully weigh these competing factors when it meets to make its decision on interest rates.

The potential impact of an interest rate hike on the economy is complex and uncertain. Some economists believe that a rate hike could help to further cool inflation by making it more expensive to borrow money and therefore reducing demand. Others argue that a rate hike could slow economic growth by discouraging businesses from investing and consumers from spending. The Fed will need to consider all of these factors when making its decision.

The connection between inflation and interest rates is a complex one, and there is no easy answer to the question of whether or not the Fed should raise rates. The Fed will need to carefully weigh all of the available data and consider the potential impact of its decision on the economy before making a decision.

Gala Cười: Đêm Hội Tiếu Thoại Thăng Hoa, Ultimate Guide To Alternate Side Parking Rules And Regulations, Duke Score: A Reliable Tool For Predicting Cardiac Surgery Risk, Xfinity: The Ultimate Entertainment And Connectivity Bundle For Your Home, Keegan Bradley: PGA Tour Champion And Major Contender, Brock Anderson: Award-Winning Wildlife Photographer And Conservationist, Modern And Elevated Menswear: Discover Willy Chavarria's Distinctive Collection, Unlock Wholesale Savings And Exclusive Perks With A Costco Membership, Kentucky Wildcats Vs. Tennessee Volunteers: Rivalry Reignites In SEC Showdown, The Indispensable Guide To Enhancing Accountability: Inspector General's Comprehensive Audit And Evaluation Services,