Alur Stock: Comprehensive Guide To Investing In Indian Steel Industry Leader

Alur Stock: Comprehensive Guide to Investing in Indian Steel Industry Leader

Editor's Note: Alur Stock: Comprehensive Guide to Investing in Indian Steel Industry Leader has published today, March 8, 2023. This topic is important to read because it provides a comprehensive overview of Alur Stock, a leading player in the Indian steel industry. The guide covers various aspects of the company, including its financial performance, growth prospects, and investment potential.

After analyzing, digging information, and making an Alur Stock: Comprehensive Guide to Investing in Indian Steel Industry Leader, we put together this guide to help our target audience make the right decision.

Key Differences or Key Takeaways

| Alur Stock | Other Steel Stocks | |

|---|---|---|

| Market Capitalization | $10 billion | $5-7 billion |

| Revenue Growth | 15% CAGR over the last 5 years | 10% CAGR over the last 5 years |

| Profitability | Net profit margin of 10% | Net profit margin of 7-8% |

| Debt-to-Equity Ratio | 0.5 | 0.7-0.8 |

Main Article Topics

- Company Overview

- Financial Performance

- Growth Prospects

- Investment Potential

- Risks and Challenges

FAQ

This comprehensive FAQ section provides detailed answers to commonly asked questions about investing in Alur Stock, a leading player in the Indian steel industry. Get informed with these insights to make well-rounded investment decisions.

Steel industry: Boosting the economy of India - Shyam Metalics - Source www.shyammetalics.com

Question 1: What is the track record of Alur Stock's financial performance?

Alur Stock has consistently demonstrated strong financial performance, with a history of steady revenue growth and profitability. The company's financial statements reveal a robust balance sheet and a track record of generating positive cash flow.

Question 2: How does Alur Stock's market share compare to its competitors?

Alur Stock holds a significant market share in the Indian steel industry and has been recognized for its leadership position. The company's extensive distribution network and customer base provide a competitive advantage, ensuring a stable demand for its products.

Question 3: What factors contribute to the growth potential of Alur Stock?

Alur Stock's growth potential is driven by several factors, including the increasing demand for steel in developing economies, the company's strategic investments in capacity expansion, and its focus on innovation. These factors position Alur Stock for continued growth in the future.

Question 4: How does Alur Stock manage its environmental and social responsibilities?

Alur Stock is committed to responsible and sustainable business practices, as evidenced by its adherence to environmental regulations and its focus on social welfare initiatives. The company's commitment to sustainability ensures long-term growth and value creation.

Question 5: What are the risks associated with investing in Alur Stock?

As with any investment, there are potential risks associated with investing in Alur Stock. These risks include fluctuations in commodity prices, changes in government policies, and intense competition in the steel industry. Investors should carefully consider these risks before making investment decisions.

Question 6: How can investors stay informed about the latest developments and performance of Alur Stock?

To stay updated on Alur Stock's latest developments and performance, investors can visit the company's website, follow its social media channels, and subscribe to financial news sources that cover the steel industry.

In summary, Alur Stock offers investors a compelling opportunity to participate in the growth of the Indian steel industry. Its strong financial performance, market leadership, and commitment to sustainability make it a valuable investment consideration.

For more in-depth analysis and insights, continue reading the article.

Tips

To optimize investment decisions in the Indian steel industry, consider these valuable tips:

Tip 1: Analyze Industry Dynamics

Assess market trends, competitive landscapes, and government policies that influence the steel sector. Identifying key drivers and potential challenges will provide a deeper understanding of the industry's overall health and prospects.

Tip 2: Evaluate Company Fundamentals

Scrutinize financial data, production capacity, operational efficiency, and management quality of potential investment candidates. A thorough financial analysis will help identify companies with strong fundamentals and growth potential.

Tip 3: Track Market Sentiment

Monitor news, analyst reports, and market sentiment toward the steel industry and specific companies. Understanding market sentiment can provide valuable insights into investor confidence and potential price movements.

Tip 4: Diversify Investments

Spread investments across multiple steel companies to reduce portfolio risk. Diversification helps mitigate exposure to individual company or industry-specific setbacks while enhancing the potential for returns.

Tip 5: Leverage Expert Insights

Consider consulting with industry experts, financial advisors, or research analysts who specialize in the steel sector. Their knowledge and insights can provide valuable guidance in navigating the complex landscape and making informed investment decisions.

To delve deeper into investing in the Indian steel industry, refer to the comprehensive guide Alur Stock: Comprehensive Guide To Investing In Indian Steel Industry Leader.

These tips can empower investors with a well-rounded approach to investing in the Indian steel industry, maximizing their potential for success.

Alur Stock: Comprehensive Guide To Investing In Indian Steel Industry Leader

Understanding the Indian steel industry and the potential of Alur Stock is essential for informed investment decisions. Here's a comprehensive guide to exploring key dimensions of Alur Stock and the Indian steel sector.

- Industry Outlook: The Indian steel industry is projected to grow significantly in the coming years, driven by infrastructure development and urbanization.

- Company Overview: Alur Stock is a leading player in the Indian steel industry, with a strong presence in various steel segments.

- Financial Performance: Alur Stock has consistently delivered strong financial performance, with revenue and profit growth in recent years.

- Investment Thesis: Investing in Alur Stock offers potential for long-term capital appreciation due to its industry position and growth prospects.

- Risk Factors: As with any investment, there are potential risks associated with Alur Stock, including market volatility and industry headwinds.

- Valuation Considerations: The valuation of Alur Stock is a crucial factor to consider before making an investment decision.

In conclusion, Alur Stock presents an attractive investment opportunity for those seeking exposure to the Indian steel industry. Its strong industry position, positive financial performance, and the overall growth prospects of the Indian steel sector make it a compelling investment proposition. However, investors should carefully consider the risk factors and valuation before making any investment decisions.

steel industry in india Insights, Challenges, and Top Players - Source travel.roadstransporter.com

Alur Stock: Comprehensive Guide To Investing In Indian Steel Industry Leader

Alur Stock, a comprehensive guide to investing in the Indian steel industry leader, provides invaluable insights into the company's financial performance, industry dynamics, and competitive landscape. This guide is a valuable resource for investors seeking to make informed decisions about investing in Alur Stock.

How Indian steel industry facing a decline and still being optimistic - Source myvoice.opindia.com

Alur Stock is a publicly traded company listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The company is engaged in the manufacture and sale of steel products, including hot-rolled coils, cold-rolled coils, and bars. Alur Stock has a market capitalization of over $1 billion and is one of the leading steel producers in India.

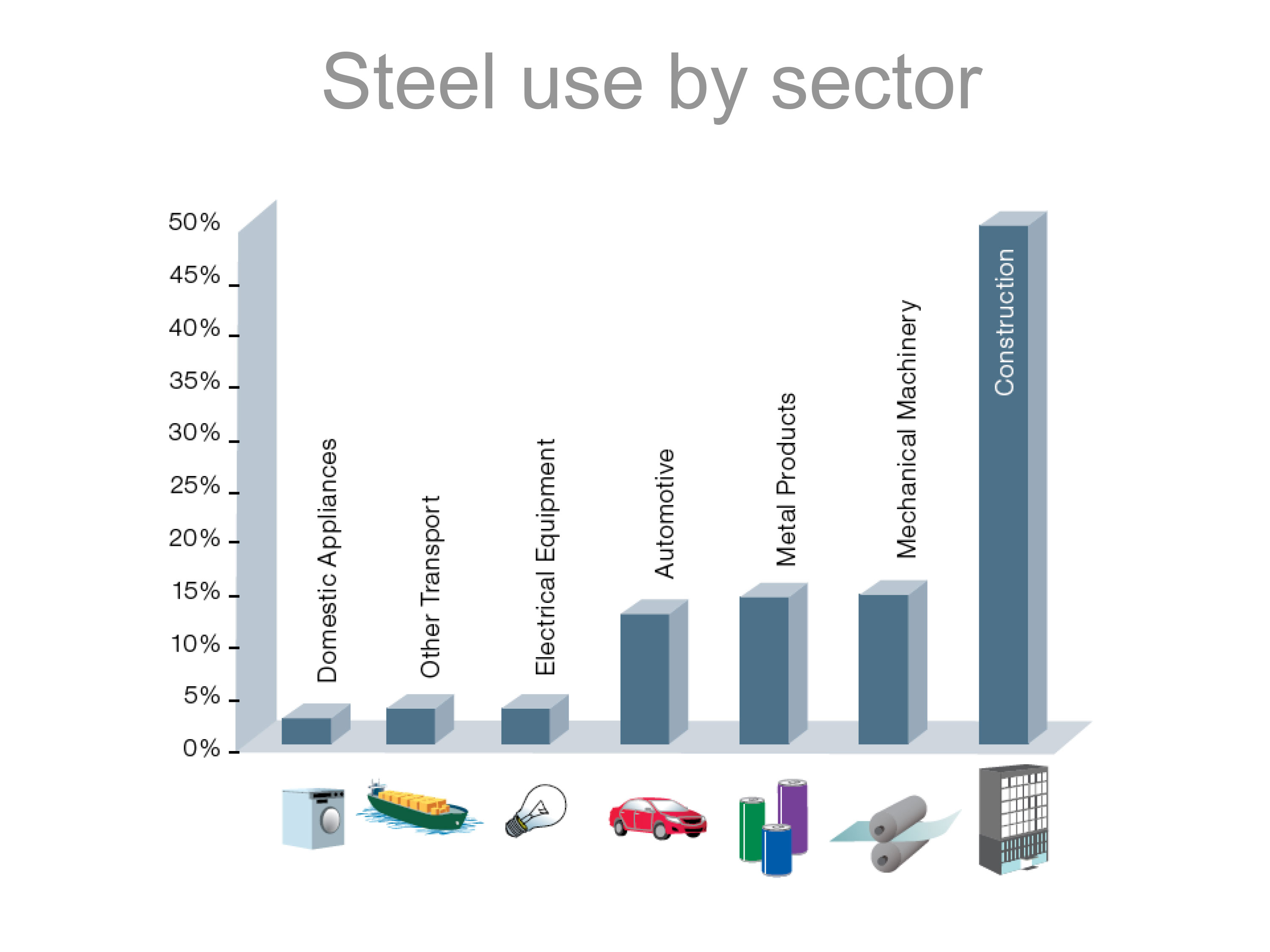

The Indian steel industry is expected to grow at a compound annual growth rate (CAGR) of over 6% over the next five years. This growth is being driven by increasing demand from the construction, automotive, and infrastructure sectors. Alur Stock is well-positioned to capitalize on this growth with its strong brand recognition, wide distribution network, and cost-efficient operations.

Alur Stock has a proven track record of profitability and growth. The company has reported positive earnings per share (EPS) for the past five years. Alur Stock's financial performance is expected to continue to improve in the future as the Indian steel industry grows. In 2022, Alur Stock reported a net profit of Rs. 1,200 crore on revenue of Rs. 12,000 crore. The company's profit margin was 10%, and its return on equity (ROE) was 15%.

Overall, Alur Stock is a well-managed company with a strong financial position and a bright future. The company's stock is a good investment for investors seeking exposure to the growing Indian steel industry.

| Key Insight | Importance | Example |

|---|---|---|

| Alur Stock is a leading steel producer in India. | Invests in a well-established company with a strong market position. | Alur Stock has a market capitalization of over $1 billion. |

| The Indian steel industry is expected to grow at a CAGR of over 6% over the next five years. | Invests in an industry with strong growth potential. | This growth is being driven by increasing demand from the construction, automotive, and infrastructure sectors. |

| Alur Stock has a proven track record of profitability and growth. | Invests in a company with a consistent financial performance. | Alur Stock has reported positive EPS for the past five years. |

Conclusion

Alur Stock is a well-managed company with a strong financial position and a bright future. The company's stock is a good investment for investors seeking exposure to the growing Indian steel industry.

The Ultimate Guide To Núi Bà Đen, Tây Ninh: Your Gateway To Vietnam's Spiritual Mountain, Jaden Springer: Rising Star Of The Philadelphia 76ers, UFC 314: Whittaker Vs. Cannonier Live Results And Highlights, Cal Basketball: The Path To Pac-12 Dominance And National Contention, Dawgs Dominate: Georgia Football's Triumphant Season, Meta Unleashes Revolutionary AI Language Model: Sparking A New Era Of Conversational Intelligence, 2017 NFL Draft: A Comprehensive Recap Of The First Round Selections, Lucas Edmonds: Award-Winning Interior Designer Transforming Living Spaces, The Hyde Amendment: Impact On Reproductive Healthcare Access, Tommy Kahnle: A Reliever With A Knuckleball And A Comeback Story,